EUROGPB presents itself as a multi-asset CFD trading platform covering forex, stock CFDs, indices, and commodities. The website highlights low spreads, fast execution, and multi-terminal access, but most verifiable information still comes primarily from its own disclosures rather than independent public channels. Based on domain history, entity transparency, regulation claims, traffic signals, and trading condition disclosure, EUROGPB currently shows several gaps that users should understand before making any trading decisions.

Platform Positioning and Product Scope

A Multi-Asset CFD Offering Built for Retail Traders

EUROGPB’s product structure matches a common CFD brokerage layout. The platform states that users can access multiple markets through one trading account, including forex pairs, indices, commodity CFDs, and stock CFDs. This broad coverage is typically designed for retail traders who want variety without managing multiple platforms.

Execution and Cost Messaging as Core Selling Points

The website frequently promotes low spreads and fast execution. These claims are widely used in the industry, but they carry weight only when supported by detailed pricing disclosure, execution standards, and verifiable operational oversight. Without those layers, cost and performance statements remain difficult to evaluate objectively.

Domain History and Online Footprint

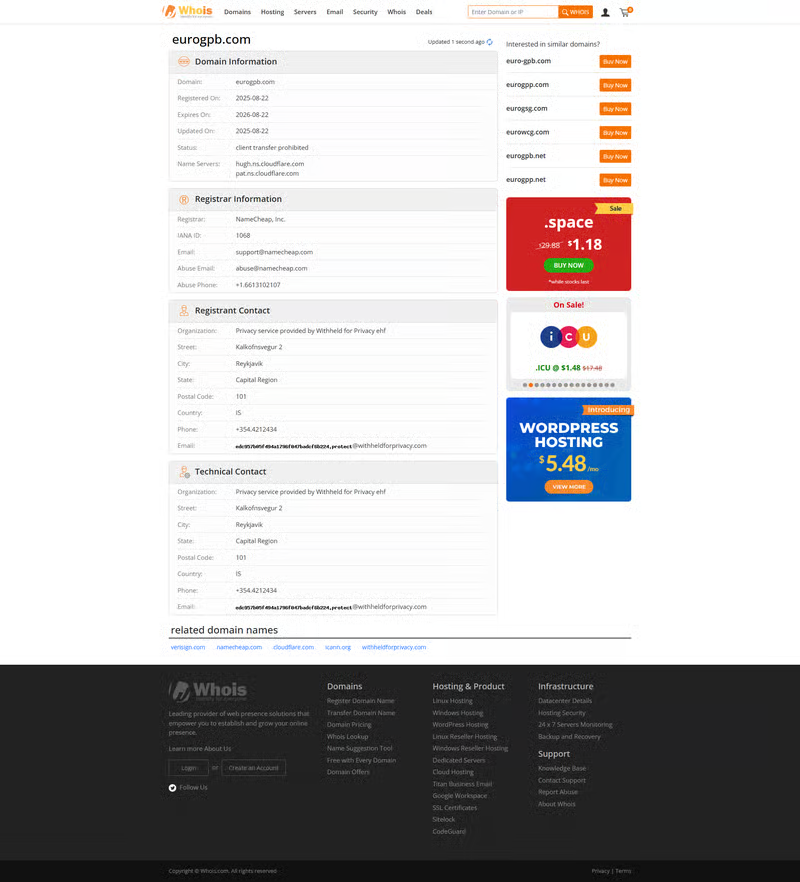

Newly Registered Domain With Limited Public Track Record

According to WHOIS records, eurogpb.com was registered on August 22, 2025, and updated on the same day. From a domain lifecycle perspective, the platform’s web presence is relatively new and lacks long-term historical visibility.

This matters because shorter public history reduces the amount of information traders can use to validate consistency. A new domain does not prove illegitimacy, but it limits the availability of archived versions, historical operational data, and long-duration user feedback.

Entity Information and Transparency

Website Disclosure: Name and Registration Number Only

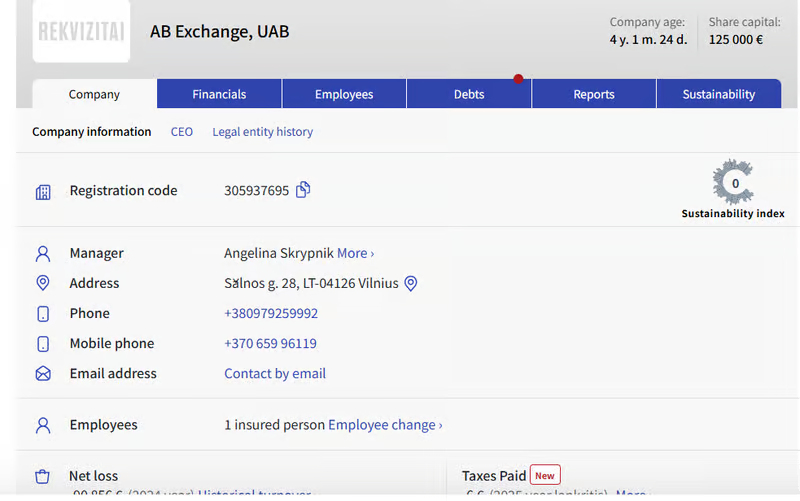

EUROGPB states that its operating entity is AB EXCHANGE, UAB and lists the registration number 305937695. However, the website does not clearly provide additional details such as a complete registered address, corporate structure explanation, or operational responsibility statement tied to brokerage services.

Third-Party Registry: Entity Exists, But Link to Platform Remains Unclear

In the Lithuanian corporate registry, AB Exchange, UAB (305937695) can be found, including registration status and a registered address. This indicates that the company name and number correspond to a real corporate entry.

The core issue is that EUROGPB does not directly present this registry context or explain how corporate registration connects to brokerage operations, client account servicing, or the legal obligations behind the platform. That gap makes it harder for users to understand who holds responsibility if disputes arise.

Regulation Claims and Verification Gaps

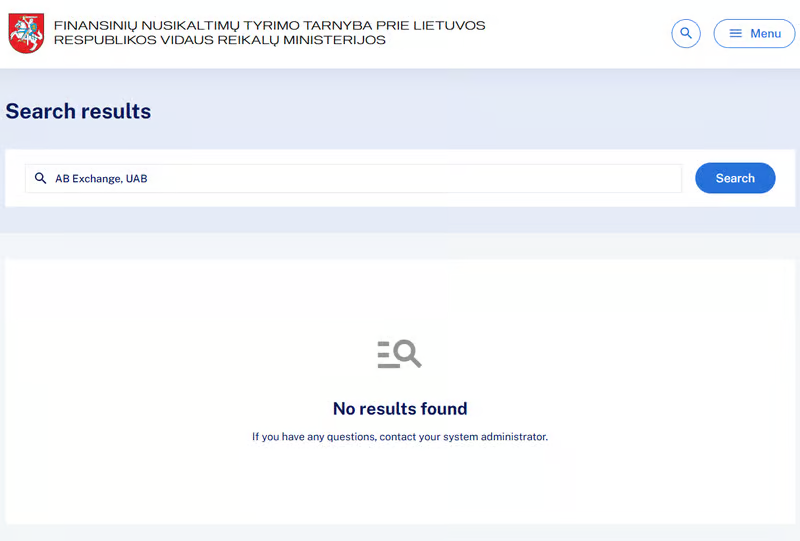

FCIS Regulation Statement Lacks Public Matching Records

EUROGPB claims to be regulated by FCIS, but in public FCIS channels no direct record corresponding to EUROGPB or AB Exchange, UAB could be confirmed through available verification routes. This creates a mismatch between what the platform implies and what users can validate externally.

Mixed License References Without Clear Attribution

The website also includes a cluster of regulatory-looking references in the same paragraph, such as Euronext AFFILIATED BROKERS EXCHANGE INC, license number 20-70-62003, the Financial Services and Markets Act 2000, and Regulations 1001 / RF: 763894. These elements appear together but are not clearly explained, and the platform does not specify which regulator issued what authorization or which entity each number belongs to.

When regulation content lacks official verification links and clear licensing definitions, it becomes difficult for users to confirm legitimacy. In financial services, unclear compliance wording is a major transparency risk because it affects how users interpret protection and oversight.

Trading Conditions and Cost Disclosure

Leverage: Stated Maximum With Limited Detail

EUROGPB indicates leverage up to 1:30, which aligns with common retail settings in many jurisdictions. However, the website does not clarify whether leverage varies by asset class, account type, or risk controls. Without these rules, leverage statements remain incomplete as a decision reference.

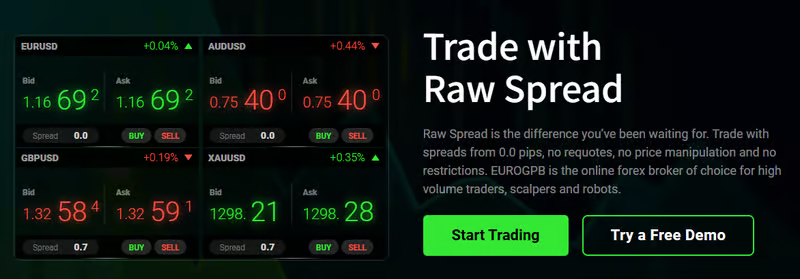

Spread Claims: “0.0 Pips” Without Typical Spread Data

EUROGPB promotes “0.0 pip spreads” as a key advantage. Minimum spreads alone do not reflect real trading cost, especially during volatility. The platform does not publicly disclose average spread ranges, typical spread levels for major instruments, or a clear pricing table that users can reference before funding.

Without data depth, cost claims become marketing language rather than measurable trade conditions.

Account Types and Deposit Threshold Design

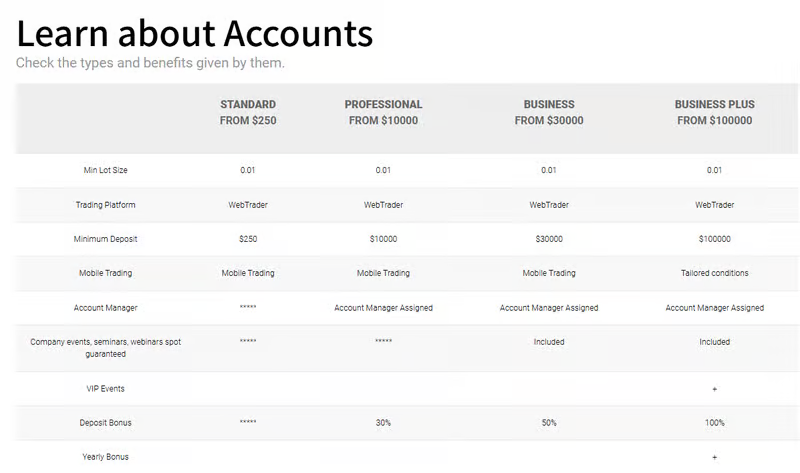

Tiered Accounts With Wide Deposit Gaps

EUROGPB lists several account tiers, including STANDARD, PROFESSIONAL, BUSINESS, and BUSINESS PLUS. The minimum deposits reportedly range from $250 to $100,000.

The main public differentiation appears to be deposit size, while the platform provides limited detail explaining whether higher tiers offer different spreads, different fees, execution priority, or withdrawal handling. Without clearly documented benefits, traders cannot objectively judge whether account tiers represent real value differences or primarily encourage larger deposits.

Trading Software and Terminal Access

Multi-Terminal Availability Without System Clarity

EUROGPB provides download links for Android, iOS, and Desktop, suggesting multi-terminal access. However, the platform does not confirm whether it runs on MT4, MT5, or another recognized infrastructure. It only indicates that trading terminals exist.

For traders, system transparency matters because the underlying architecture impacts execution reliability, order handling, pricing feeds, chart tools, and compatibility with common trading workflows.

Deposits, Withdrawals, and Funding Transparency

Multiple Payment Methods Listed, But Rules Are Not Publicly Defined

The platform claims to support VISA, Mastercard, American Express, NETELLER, Skrill, and wire transfers. While this suggests broad funding options, it does not confirm actual availability by region or account status.

The website does not clearly disclose processing times, deposit or withdrawal fees, verification rules, or whether withdrawal requirements differ between account tiers. These are critical details for users because funding issues are among the most common disputes in online trading environments.

Website Traffic and Public Visibility Signals

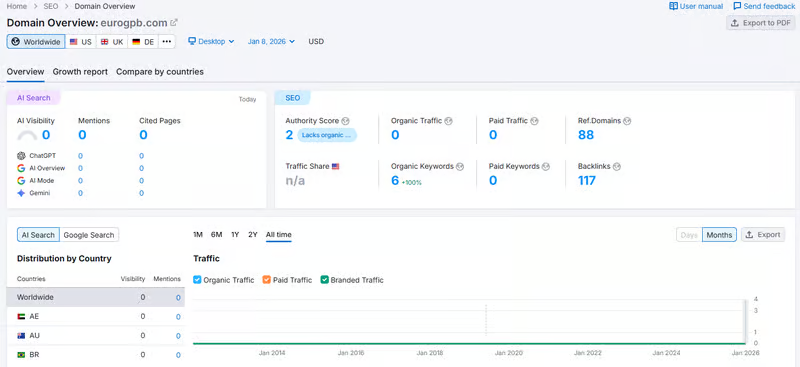

Semrush Shows Near-Zero Monthly Traffic

According to Semrush data, eurogpb.com has nearly zero monthly traffic, indicating extremely low search visibility and minimal public reach. This suggests the platform may not yet have a meaningful organic user base, at least in terms of measurable public traffic signals.

Low traffic is not direct proof of wrongdoing, but it reduces the number of external trust signals such as independent reviews, user discussions, and reputation history that traders often rely on.

Registration Process and User Experience Observations

Navigation Is Usable, But Information Discovery Can Be Inefficient

EUROGPB’s website layout is readable and users can locate core functional pages. However, some categories are broadly defined, which may require extra browsing to find detailed policies and account specifications.

Registration Form Has Prompts, But Formatting Guidance Is Limited

The registration page provides basic prompts, yet some fields lack clear input rules. This can create trial-and-error behavior for users trying to submit correct information, increasing uncertainty during onboarding.

Bottom Line

EUROGPB shows a familiar multi-asset CFD broker framework, including product variety, account tiers, multi-device access, and common payment method branding. The primary exposure issue is that key trust components remain difficult to independently verify, particularly regulatory claims, licensing references, and trading cost transparency. For users, the difference between a platform that looks complete and one that can be validated through official sources often determines whether its claims translate into reliable trading conditions in practice.