SIMARTEX positions itself as a modern fintech investment platform, but when its domain history, corporate registration, regulatory claims, and market visibility are examined together, a large gap emerges between marketing language and verifiable facts. While the company promotes advanced technology, professional teams, and regulatory compliance, publicly available records reveal multiple structural weaknesses that investors should not ignore.

Platform Positioning and Public Narrative

SIMARTEX promotes itself as a technology-driven financial services provider designed to offer a safe and efficient trading environment. According to its website, the company integrates professional traders, analysts, developers, and security specialists to support clients around the clock from registration through trading and fund management.

On the surface, this narrative suggests a comprehensive fintech ecosystem. However, external verification shows that much of this positioning is not supported by independent data.

Domain History and Website Continuity

A Domain That Looks Old but Acts New

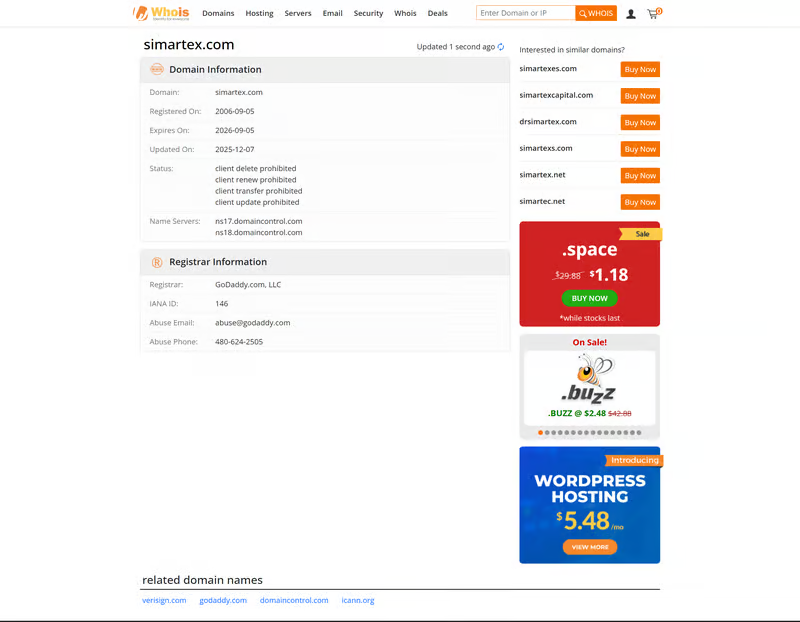

The domain simartex.com was first registered in 2006 and most recently updated in late 2025. This gives the impression of a long-established brand. However, archived web records tell a different story. The website appeared in 2008, but after 2013 the domain was used by unrelated businesses and went through long periods of inactivity or repurposing.

The current SIMARTEX trading platform only began operating on this domain in its latest form in recent years, meaning the brand’s online continuity does not match the age of the domain.

Why This Matters for Investors

In financial services, a long operating history normally implies stability and regulatory evolution. When a domain has been recycled or repurposed, that history cannot be used as evidence of business longevity. This weakens SIMARTEX’s implied credibility based on its domain age.

Corporate Registration Status

UK Company Records

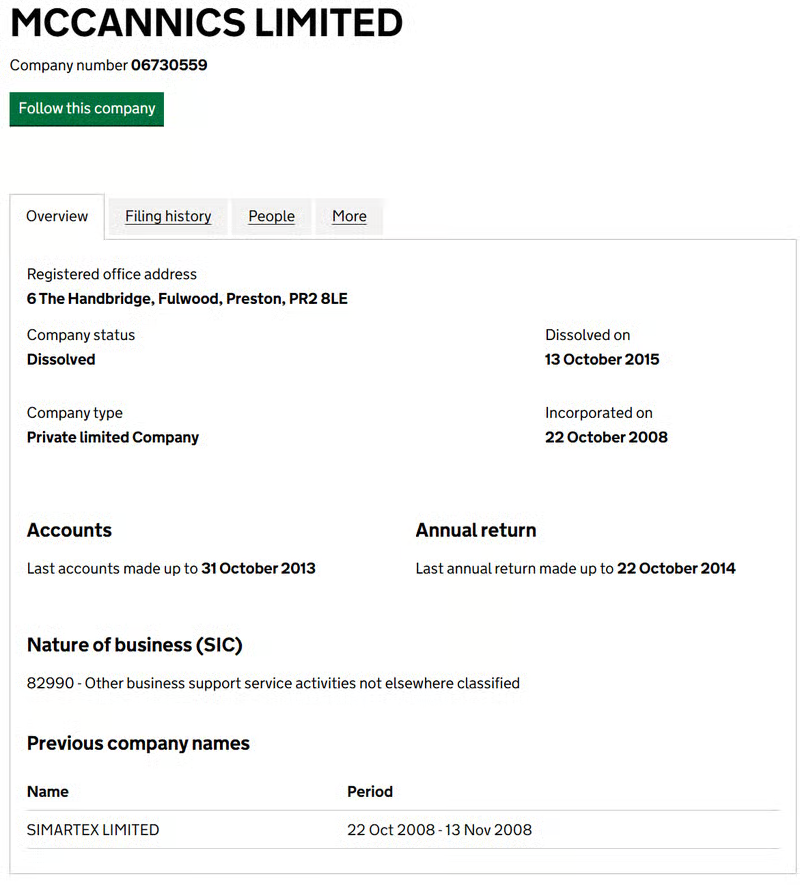

SIMARTEX refers to a UK corporate entity in its disclosures. However, a search in Companies House shows that the relevant company has been dissolved. A dissolved company no longer exists as a legal operating entity in the United Kingdom.

Legal and Operational Implications

A dissolved company cannot legally provide financial services, hold client funds, or act as a regulated intermediary. If SIMARTEX continues to reference this entity, it raises serious questions about what company, if any, actually stands behind the platform today.

Regulatory Claims and Verification

FCA Authorization Statements

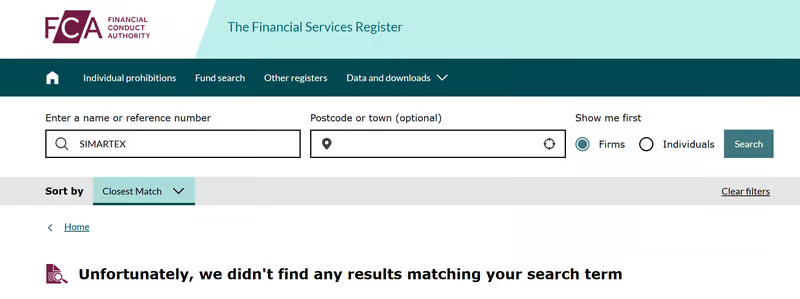

SIMARTEX claims to be authorized and regulated by the UK Financial Conduct Authority. The FCA is one of the most respected financial regulators in the world and maintains a public register of all licensed firms.

Regulatory Database Reality

When SIMARTEX is searched in the FCA register, no matching firm name, reference number, or legal entity can be found. This means that its regulatory claim cannot be confirmed through the official regulator’s database.

Why This Is a Critical Issue

Regulatory authorization is not a marketing label. If a company is truly regulated, it must appear in the regulator’s public records. The absence of SIMARTEX from the FCA database directly contradicts its own claims.

Trading Products and Market Scope

SIMARTEX advertises trading access to forex, stocks, indices, cryptocurrencies, and commodities. This product mix is typical of CFD platforms and covers the main asset classes retail traders look for.

However, SIMARTEX does not disclose contract specifications, trading conditions, execution models, or liquidity sources. Without these details, traders cannot evaluate how prices are formed or how orders are handled.

Trading Platform Transparency

Missing Platform Disclosure

SIMARTEX does not publicly identify what trading software it uses. There is no confirmation of MetaTrader 4, MetaTrader 5, web-based terminals, or proprietary systems. There is also no download page, demo environment, or platform documentation.

Why Platform Openness Matters

The trading platform is the core infrastructure of any broker. Without knowing the software being used, clients cannot assess execution quality, order routing, price integrity, or technical reliability. This level of opacity is highly unusual for a company claiming professional fintech standards.

Website Traffic and Market Presence

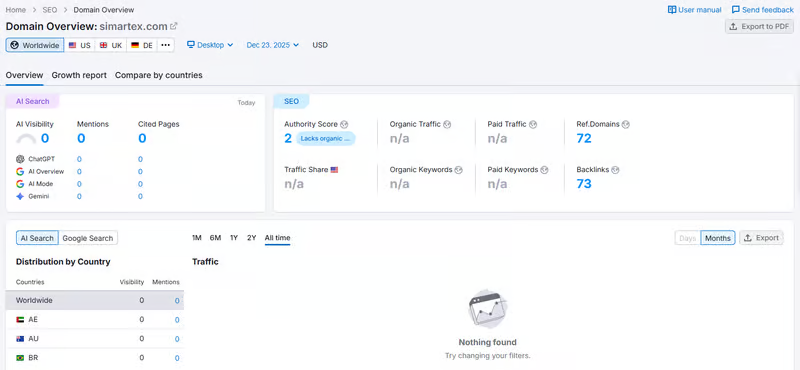

According to SEMrush data, simartex.com has no measurable organic search traffic, no ranking keywords, and an Authority Score of only 2. This suggests that the platform has almost no digital footprint in the trading industry.

Even newly launched brokers normally generate some level of online activity. A platform that claims to offer global fintech services but shows no meaningful visibility appears disconnected from the wider market.

Account Structure and Cost Transparency

SIMARTEX does not publish information about account tiers, minimum deposits, spreads, commissions, or trading privileges. This prevents potential users from understanding the financial terms of using the platform or comparing it with other brokers.

In regulated markets, transparent disclosure of trading conditions is a basic requirement. Its absence further reduces confidence in the platform’s operational standards.

Communication Channels and Client Access

SIMARTEX only provides an email address and a Telegram support bot. There is no public phone number, no live chat system, and no verifiable customer service center.

For financial services, limited communication channels reduce accountability and make dispute resolution significantly more difficult.

Address and Physical Footprint

The platform lists a Leeds, UK address as its registered location. However, without an active company registration and without FCA authorization, this address cannot be linked to a licensed financial services firm.

Overall Exposure Conclusion

SIMARTEX presents itself as a regulated, professional fintech trading platform, but its public records tell a different story. A recycled domain, a dissolved UK company, unverifiable FCA regulation, undisclosed trading software, zero market visibility, and minimal client support channels together create a profile that lacks transparency and institutional credibility.

For investors, this combination of factors suggests that SIMARTEX should be approached with extreme caution and independently verified before any financial engagement.

SIMARTEX

What is SIMARTEX?

SIMARTEX is an online trading platform that offers access to multiple CFD markets including forex, stocks, indices, cryptocurrencies, and commodities.

Is SIMARTEX a regulated broker?

SIMARTEX claims to be regulated by the UK Financial Conduct Authority, but no matching record for the platform appears in the FCA public register.

How long has SIMARTEX been operating?

The simartex.com domain was first registered in 2006, but historical records show that the domain was used by different entities over time, and the current trading platform appears to be relatively recent.

What trading platform does SIMARTEX use?

SIMARTEX does not publicly disclose what trading software or platform it operates, and there is no confirmed information about MT4, MT5, or other systems.

Does SIMARTEX provide clear account and cost information?

The platform does not publish detailed information about account types, spreads, commissions, or minimum deposits, making its trading conditions difficult to assess from public sources.

How can users contact SIMARTEX?

SIMARTEX provides support through an email address and a Telegram support bot, with no publicly listed phone or live chat service.