Trillion Trades presents itself as a global forex and CFD broker built on advanced technology and transparency. However, when its public disclosures are examined more closely, several gaps emerge around platform verification, regulatory clarity, product transparency, and online footprint. This exposure-style review organizes what is publicly available and highlights areas that traders may wish to scrutinize more carefully before engaging with the platform.

Brand Positioning vs. Verifiable Reality

How Trillion Trades Describes Itself

Trillion Trades promotes an image of a modern, technology-driven brokerage. On its website, the company emphasizes institutional-grade trading conditions, integrity, and a global client base. It also frames its history as a journey from a small fintech startup to a globally trusted trading partner.

These kinds of claims are common across the retail brokerage industry. However, from a due diligence standpoint, branding language is not evidence. What matters more is whether independent data points support the platform’s narrative.

What Can Be Verified

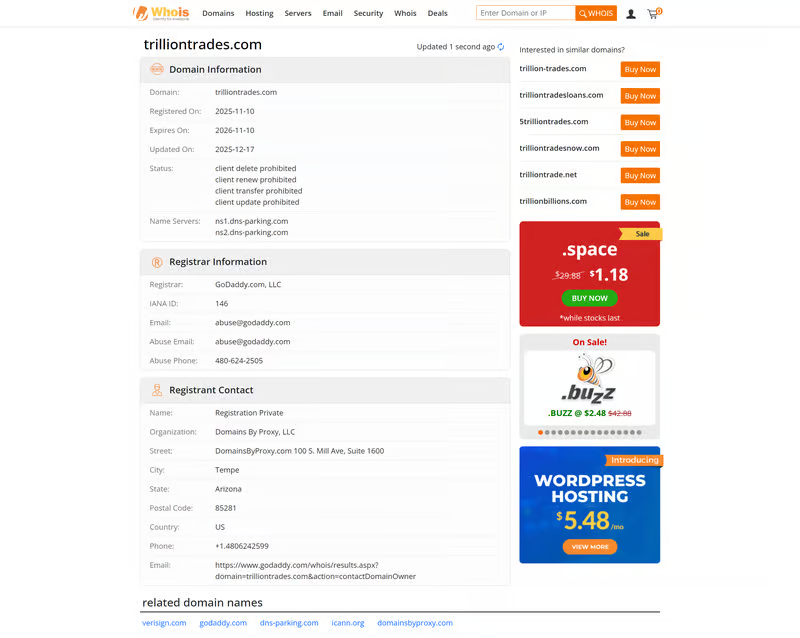

Publicly available domain records show that the website trilliontrades.com was registered in November 2025 and updated shortly after. This suggests that the web presence of the platform is relatively new. While a recent domain does not automatically indicate a problem, it does place the platform in an early-stage category when compared to brokers with longer operating histories and established regulatory footprints.

Trading Environment: What Is Offered vs. What Is Explained

Market Coverage

Trillion Trades lists a wide range of asset classes, including forex, commodities, indices, stocks, ETFs, and cryptocurrencies. On the surface, this multi-asset structure mirrors what many global CFD brokers offer.

However, a closer look shows that essential trading parameters are missing from public view.

What Is Not Disclosed

There is no visible breakdown of:

- Spreads or commissions

- Leverage levels

- Contract specifications

- Swap or overnight financing rules

- Execution model or liquidity sources

Without these details, traders have no way to compare Trillion Trades’ trading conditions with other brokers or evaluate whether costs are competitive.

Platform Claims and Verification Gaps

Advertised Trading Platforms

The broker claims to support MetaTrader 5, a WebTrader, and a mobile trading application. These are standard tools in the online trading industry and are often considered essential for professional-level access.

Where the Questions Begin

Despite these claims, there is no publicly accessible MT5 server listing, no verified app store presence, and no demo or live login environment available for independent checking. This means traders cannot confirm:

- Whether MT5 is actually connected to the broker

- Whether orders are executed through a real trading server

- Whether the mobile and web platforms exist in functional form

For a broker emphasizing technology and transparency, the inability to verify its trading infrastructure raises legitimate questions.

Registration and Regulation: Two Very Different Things

Company Registration

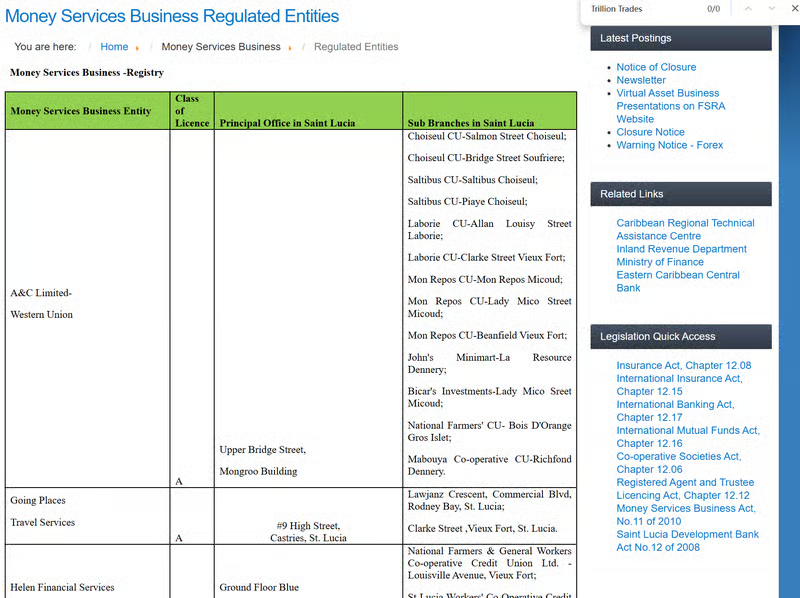

Trillion Trades lists a registration in St. Lucia, referencing the International Business Companies and Trust Registry. This indicates that a legal entity may exist under local corporate law.

Why Registration Is Not Regulation

Company registration simply means that a business can legally exist. It does not mean the firm is licensed to provide financial or brokerage services.

Regulatory Oversight Status

No clear regulatory license numbers, no supervisory authority links, and no searchable regulatory records have been published. Furthermore, there is no confirmed record of authorization from the St. Lucia Financial Services Regulatory Authority for providing trading or brokerage services.

This distinction is critical. Without regulatory oversight, there are no enforced rules regarding:

- Client fund segregation

- Complaint resolution

- Capital adequacy

- Reporting and audits

Online Visibility and Market Presence

Website Traffic and Search Footprint

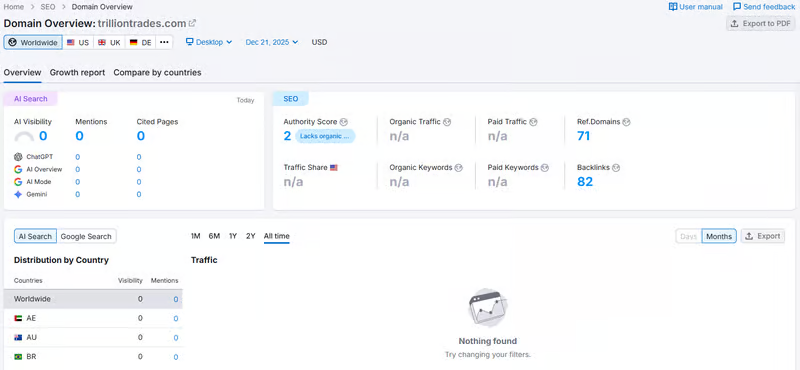

Public traffic tools show that trilliontrades.com has very low visibility. The site has an Authority Score of 2 and no meaningful organic search traffic or keyword ranking.

This suggests the platform has not yet built a recognizable digital footprint in the trading community, which is unusual for a broker claiming to serve thousands of clients worldwide.

Absence of Social Channels

Trillion Trades also appears to operate without public social media accounts. For brokers, social channels are often used to publish:

- Trading hour updates

- Platform maintenance notices

- Market news

- User engagement

Without these channels, traders have fewer ways to monitor platform activity or receive real-time communication.

Education and Support Structure

Basic Learning Content

The broker does provide introductory educational material focused on forex basics. This can be helpful for beginners who are just learning about trading concepts.

What Is Missing

There is no transparency about:

- Who writes or reviews the content

- Whether materials are regularly updated

- How risk warnings are presented

- Whether any structured learning paths exist

This makes it difficult to assess the educational credibility of the platform.

Contact Details and Physical Presence

What Is Provided

Trillion Trades lists an email address, a phone number, and a physical address in Gros Islet, St. Lucia.

What Cannot Be Confirmed

There is no independent verification of operational offices, trading floors, or regulatory supervision tied to this address. As with many offshore-registered entities, the address may serve administrative purposes rather than representing a regulated financial operation.

Bottom Line

Trillion Trades presents itself as a global, technology-driven broker, but its publicly available data paints a much less complete picture. Key areas such as regulatory authorization, platform verification, trading conditions, and market presence remain either unclear or undocumented. For traders, this means that much of what matters most—how trades are executed, how funds are protected, and who oversees the business—cannot be independently verified from current public sources.