Exo Capitals promotes itself as an online CFD trading platform providing access to multiple asset classes through a unified account system and MT5 trading software. While the platform highlights broad market coverage, flexible account tiers, and claimed international regulatory affiliations, publicly available records reveal inconsistencies related to its establishment timeline, regulatory disclosures, and overall transparency. This article examines Exo Capitals’ publicly stated information alongside observable data points to outline key facts and unresolved questions.

Platform Background and Online Presence

Claimed Establishment Versus Website Records

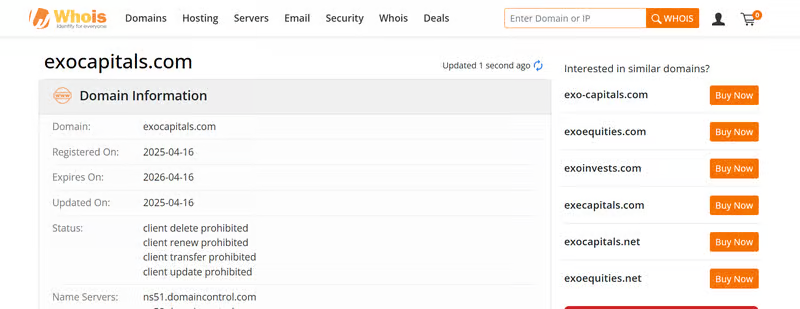

Exo Capitals states on its official website that the brand was established in 2013 and operates under the entity name Exo Capitals Ltd. However, publicly accessible domain registration records show that the website exocapitals.com was registered on April 16, 2025, with no earlier historical records available.

At present, no public explanation clarifies whether the platform previously operated under a different domain or how its claimed years of operation align with the relatively recent website registration. This disconnect between the stated founding year and observable domain data leaves the platform’s early operational history unclear.

Digital Visibility and Market Exposure

From a visibility standpoint, Exo Capitals maintains a limited online footprint. Third-party traffic estimation tools indicate that monthly visits to the official website remain below one hundred. For a platform that claims more than a decade of operation, this level of online engagement appears relatively modest and does not independently confirm a large or established user base.

Tradable Markets and Product Coverage

Multi-Asset CFD Offering

Exo Capitals positions itself as a multi-asset CFD provider, offering exposure to forex, stocks, commodities, indices, and cryptocurrencies within a single trading environment. This structure allows users to participate in different markets without maintaining multiple trading accounts across platforms.

The scope of products aligns with common offerings found among online CFD brokers. However, the platform does not publicly disclose detailed information regarding contract specifications, execution models, or liquidity arrangements, which limits external assessment of trading conditions.

Market Positioning

The platform’s product presentation suggests an attempt to appeal to a broad audience rather than specializing in a specific asset class. While diversity of instruments can be a practical feature, the absence of deeper disclosures makes it difficult to evaluate how these products are sourced or executed in practice.

Trading Technology and Infrastructure

MT5 Platform Support

According to its website, Exo Capitals uses MetaTrader 5 as its primary trading platform. MT5 is compatible with Windows and macOS desktop systems and supports mobile trading on both iOS and Android devices. The platform is widely used in the retail trading industry due to its charting capabilities and support for algorithmic strategies.

Server and Execution Transparency

Despite the MT5 claim, publicly available MT5 server lists do not currently show identifiable server information associated with Exo Capitals. As a result, details such as server location, execution environment, and hosting arrangements remain unverified through official MT5 infrastructure disclosures.

Account Structure and Trading Conditions

Tiered Account Framework

Exo Capitals uses a tiered account model that separates users based on minimum deposit requirements. Differences between account tiers are primarily described in terms of spread levels, commission structures, access to analytical tools, and customer support services. Leverage and margin rules are presented as broadly consistent across account types.

This structure appears designed to segment users by capital size rather than fundamentally alter market access or trading mechanics.

Focus on Capital-Based Differentiation

Higher-tier accounts emphasize additional services rather than materially different execution conditions. The platform does not provide detailed comparative tables explaining how trading costs scale across tiers, which limits transparency regarding the practical impact of account upgrades.

Deposits, Withdrawals, and Payment Processing

Funding Channels

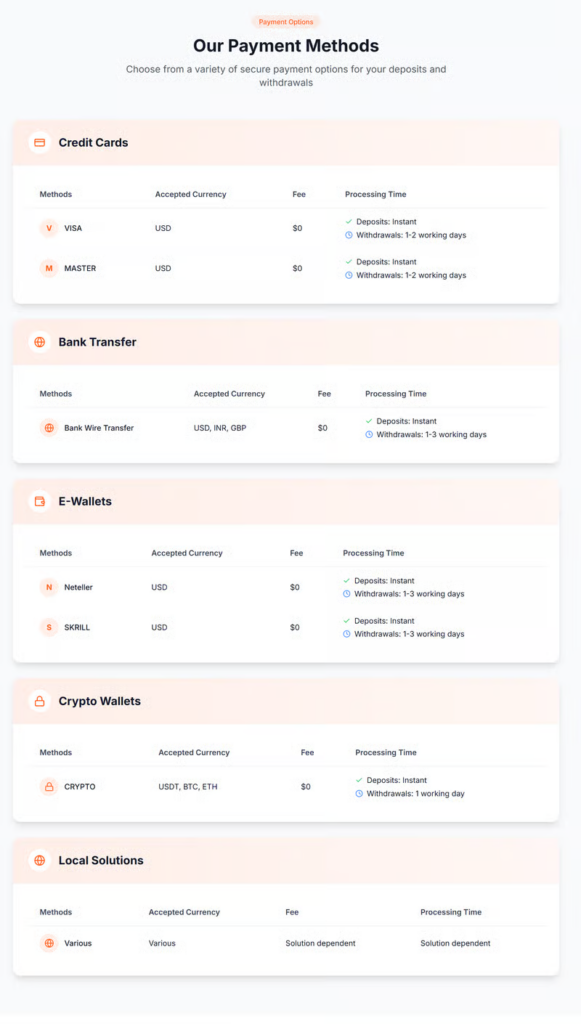

Exo Capitals states that it supports multiple deposit and withdrawal methods, including bank transfers, card payments, e-wallets, and cryptocurrencies. Deposits are described as relatively fast, while withdrawals are estimated to take one to three business days depending on the method selected.

Disclosure Scope

Specific details regarding supported currencies, transaction fees, and local payment availability are not fully centralized. Users may need to rely on method-specific explanations, which can vary by region and provider.

Regulatory Claims and Verification Status

Claimed Jurisdictional Registrations

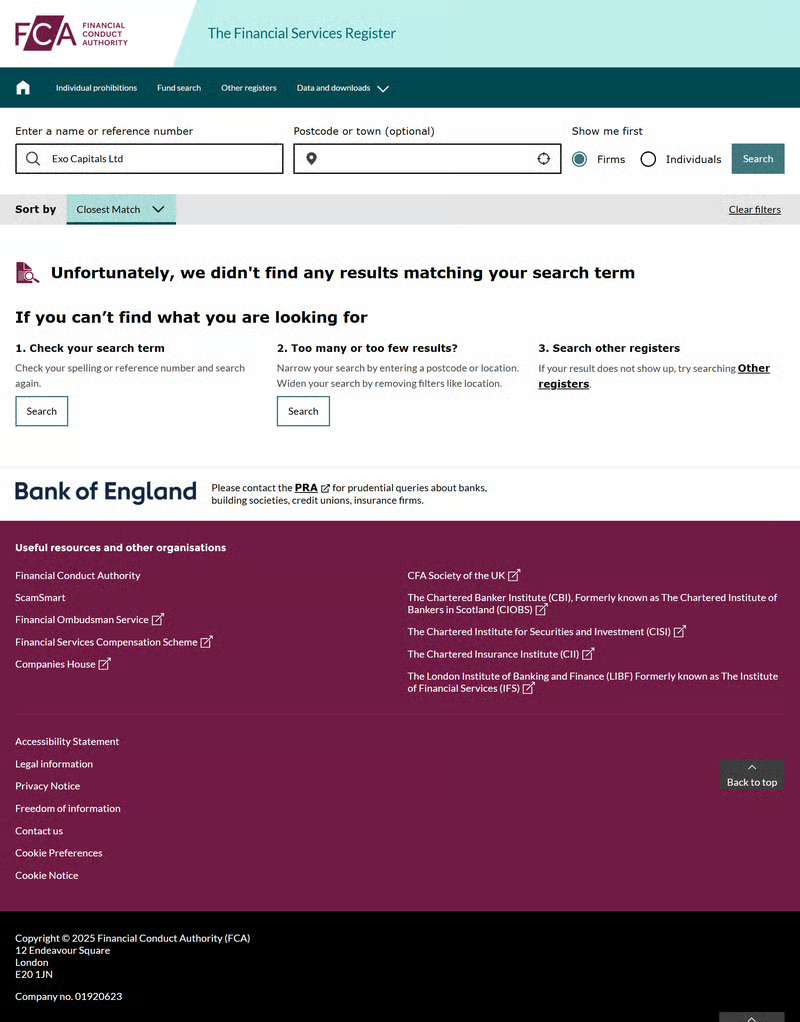

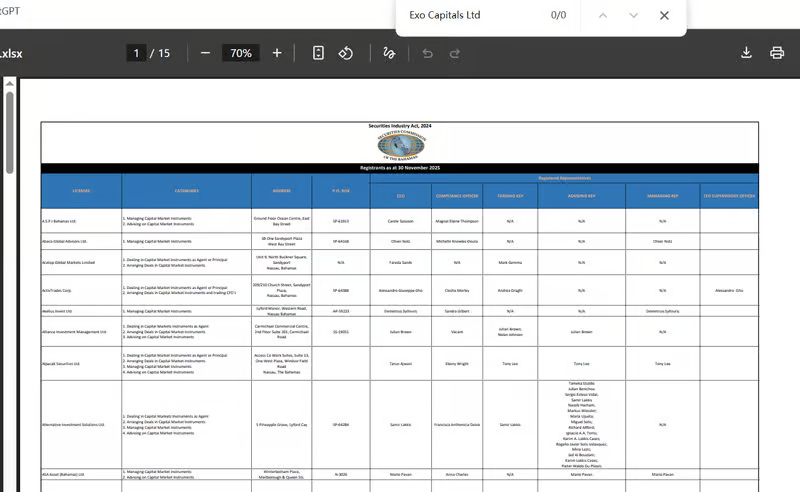

The platform claims associations with multiple regulatory bodies across different jurisdictions, including the UK, Australia, and The Bahamas. These references are used to suggest international compliance and oversight.

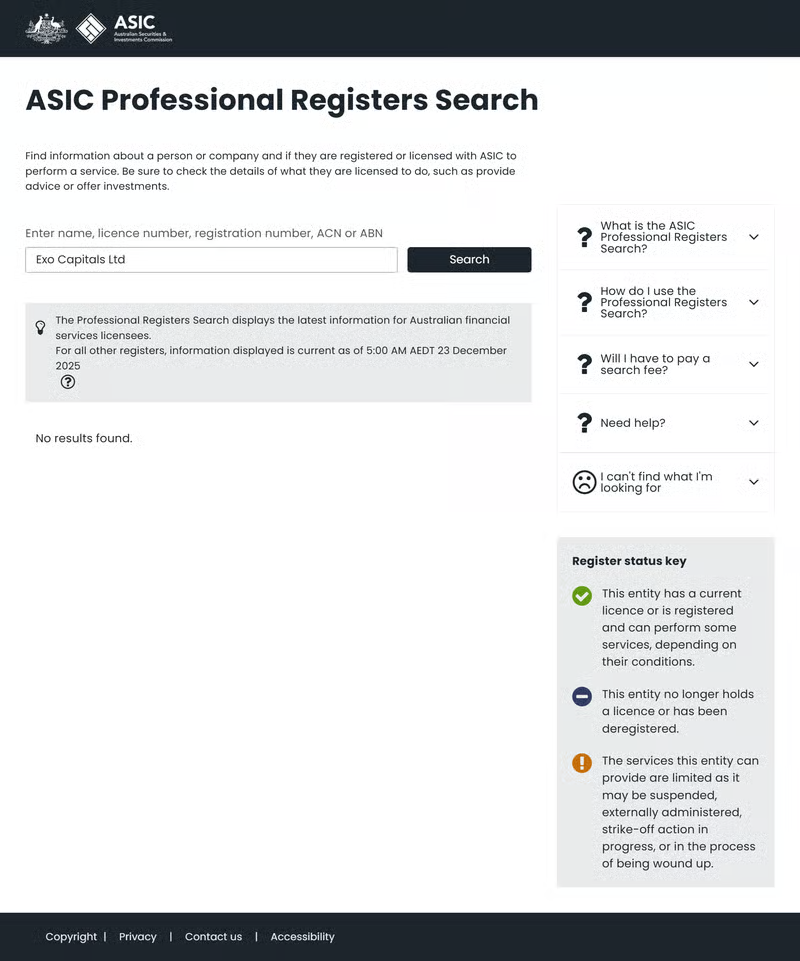

Public Record Findings

Independent checks of publicly accessible regulatory databases have not identified matching records for Exo Capitals Ltd under the cited authorities. No verifiable license numbers or official filings have been confirmed through these regulators’ public systems. As a result, the regulatory status of Exo Capitals remains unsupported by publicly verifiable evidence.

Affiliate and Agent Program

Introducing Broker Model

Exo Capitals promotes an Introducing Broker partnership program aimed at individuals and institutions. The program emphasizes commission-based cooperation, rebate incentives, performance tracking tools, and dedicated account management. Earnings calculations and settlement processes are governed by the platform’s internal policies as presented on its website.

Communication Channels and Social Media Presence

Customer Support Access

The platform lists several remote communication channels, including email, telephone support, and online contact forms. No physical office address or on-site customer service location is prominently disclosed.

Social Media Activity

Exo Capitals references multiple social media platforms. Among them, only the Facebook page currently shows visible activity related to brand promotion. Other listed platforms do not consistently link to clearly verifiable or active official accounts.

Conclusion: Disclosure Gaps Remain Central

Exo Capitals presents a comprehensive feature set that includes multi-asset CFD trading, MT5 platform support, tiered accounts, and partnership programs. However, gaps between its claimed establishment timeline and observable domain records, combined with unverified regulatory assertions and limited public visibility, raise unresolved questions about transparency.

Based on currently available information, the platform’s stated profile exceeds what can be independently confirmed through public records. Additional disclosures would be required to fully align marketing claims with verifiable operational evidence.

Exo Capitals – FAQ

What is Exo Capitals?

Exo Capitals is an online trading platform that provides Contract for Difference (CFD) trading across multiple asset classes, including forex, equities, commodities, indices, and cryptocurrencies.

When was Exo Capitals established?

The platform states that it was founded in 2013. However, public domain registration records show that its current website domain was registered in April 2025, with no publicly available explanation linking the two timelines.

What trading platform does Exo Capitals use?

Exo Capitals indicates that it uses MetaTrader 5 (MT5), which supports desktop and mobile trading. Public MT5 server information linked to the platform has not been independently verified.

What account types are available?

The platform offers several account tiers with different minimum deposit levels. Differences between accounts mainly relate to spreads, commissions, and additional services rather than leverage or market access.

What deposit and withdrawal methods are supported?

Exo Capitals lists multiple funding options, including bank transfers, cards, e-wallets, and cryptocurrencies. Processing times and fees may vary depending on the method and region.

Is Exo Capitals regulated?

The website references several regulatory authorities in different jurisdictions. However, publicly accessible regulatory databases do not currently show verified records matching the platform’s claims.

Does Exo Capitals offer partnership programs?

Yes. The platform promotes an Introducing Broker (IB) program that provides commission-based incentives and performance tracking tools, subject to its published terms.