Solr Capital presents itself as an online cryptocurrency trading platform headquartered in Luxembourg, promoting a streamlined and efficient trading experience through a proprietary system known as “Solr Trading.” However, a review of publicly available records and third-party data reveals multiple gaps between the platform’s stated profile and verifiable information. These gaps relate to corporate registration, regulatory authorization, platform transparency, online visibility, and operational disclosure, all of which merit careful scrutiny.

Claimed Background and Operational Profile

Stated Business Identity

According to its official website, Solr Capital operates as a cryptocurrency trading service provider with its headquarters located in Luxembourg. The platform emphasizes efficiency and simplicity in execution, positioning itself as a modern digital asset trading solution.

Scope of Services

Publicly available information suggests that Solr Capital’s offerings are currently limited to cryptocurrency trading. Unlike many multi-asset platforms, the website does not reference forex, commodities, indices, or other commonly offered CFD instruments, indicating a relatively narrow product scope.

Corporate Registration Verification

Luxembourg Business Register Review

Solr Capital claims registration in Luxembourg; however, a search of the Luxembourg Business Register did not return any entity matching the platform’s stated name.

Implications of Missing Records

The absence of a corresponding entry in the official corporate registry makes it difficult to confirm the legal existence of the operating entity in Luxembourg. Without verifiable registration data, the platform’s corporate status remains unclear.

Regulatory Status Assessment

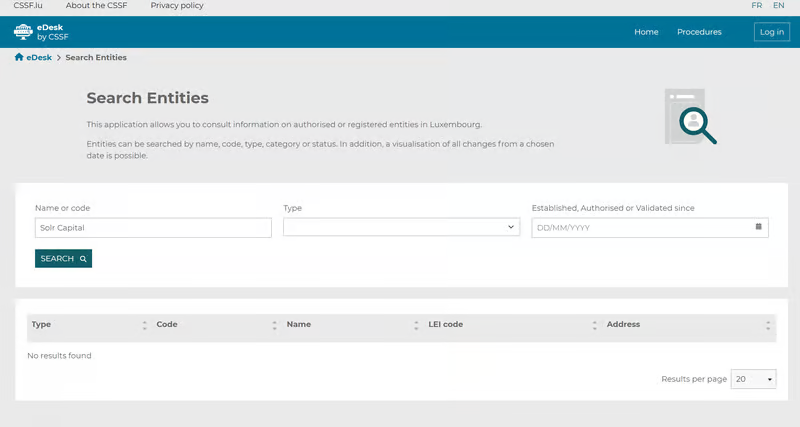

CSSF Authorization Check

Given its claimed Luxembourg base, Solr Capital would typically fall under the oversight of the Commission de Surveillance du Secteur Financier (CSSF). A review of the CSSF public registers did not identify any licensing or authorization records associated with Solr Capital.

Disclosure Limitations

The platform does not publish a regulatory license number, authorization certificate, or supervisory reference. This lack of regulatory disclosure limits users’ ability to verify whether Solr Capital operates under any recognized financial oversight framework.

Domain History and Website Lifecycle

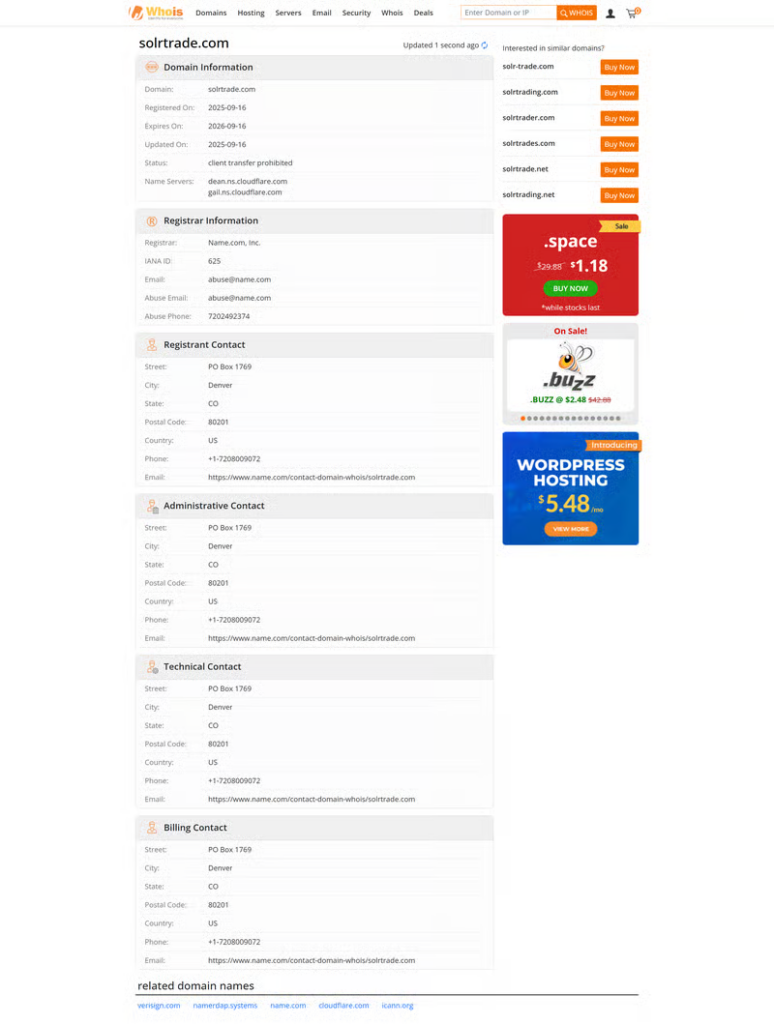

WHOIS Domain Information

WHOIS records show that the domain solrtrade.com was registered on September 16, 2025, and updated on the same date. No prior historical records are available.

Interpretation of Domain Age

The recent domain registration suggests that the website is in an early stage of operation. With no extended online history, there is limited external data available regarding long-term activity, user engagement, or operational continuity.

Website Traffic and Online Presence

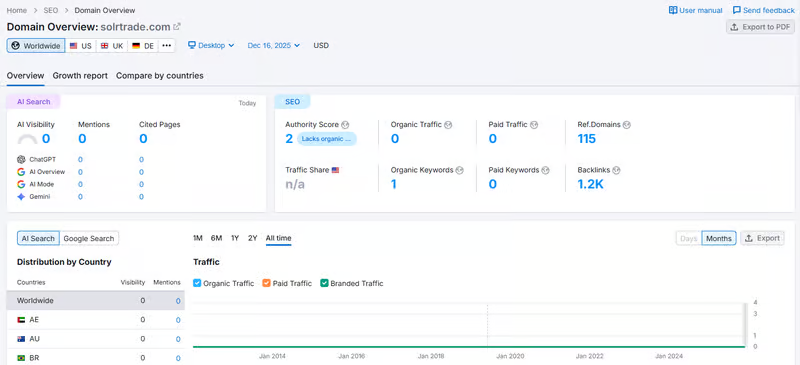

SEMrush Visibility Data

Third-party analytics data from SEMrush indicates that solrtrade.com has extremely low visibility. The site holds an Authority Score of 2, with almost no organic traffic, keyword rankings, or meaningful regional reach.

Operational Consistency Considerations

For a platform claiming to serve cryptocurrency traders, such minimal online exposure suggests either a very early launch phase or limited user adoption. In either case, it restricts independent evaluation through external reviews or market feedback.

Trading Platform and Technology Claims

Proprietary “Solr Trading” Platform

Solr Capital states that it uses a self-developed trading system called Solr Trading, designed to deliver efficient and confident execution.

Lack of Technical Transparency

No public documentation, technical specifications, or third-party references are available to confirm the platform’s actual functionality. The absence of screenshots, system architecture descriptions, or independent verification channels makes it difficult to assess the reliability or security of the claimed trading software.

Account Structure and Trading Conditions

Account Information Disclosure

Solr Capital does not disclose details regarding account types, minimum deposit requirements, spread models, commissions, or leverage structures.

Impact on User Evaluation

Without clear trading condition disclosures, potential users cannot effectively assess costs, risks, or suitability. This lack of transparency is a notable limitation for a financial trading platform.

Funding, Withdrawal, and Asset Handling

Payment and Settlement Information

The platform’s website does not provide detailed explanations regarding deposit methods, withdrawal procedures, processing timelines, or associated fees.

Asset Safety Considerations

There is no information regarding fund custody arrangements, segregation practices, or third-party security audits. As a result, the handling and protection of user assets cannot be independently verified.

Contact Channels and Communication Transparency

Available Contact Information

Solr Capital lists a single contact method via email at [email protected].

Communication Limitations

No phone numbers, live chat options, or additional support channels are disclosed. The absence of multiple communication methods may limit accessibility and responsiveness for users seeking assistance.

Social Media and Public Engagement

Social Media Presence Review

No official social media accounts associated with Solr Capital were identified at the time of review.

Implications for Transparency

For online trading platforms, social media channels often serve as tools for updates, customer engagement, and public accountability. The lack of such channels reduces visibility into ongoing operations and platform activity.

Address Disclosure and Physical Presence

Published Address Information

Solr Capital lists its registered address as 28 Boulevard Grande-Duchesse Charlotte, L-1330 Luxembourg.

Address Verification Findings

No corresponding business entity associated with Solr Capital was identified at this address in publicly available business databases. This further complicates efforts to verify the platform’s physical presence.

Overall Observations

Based on publicly accessible information, Solr Capital displays multiple areas of limited transparency, including unverified corporate registration, absence of regulatory authorization, a newly registered domain, minimal online traffic, and scarce disclosure regarding its trading platform and operational structure. While the platform positions itself as a Luxembourg-based cryptocurrency trading service, the lack of independently verifiable data suggests that careful due diligence is essential before engaging with the platform.

FAQ

What is Solr Capital?

Solr Capital is an online platform that claims to offer cryptocurrency trading services through a proprietary trading system.

Where is Solr Capital based?

The platform states that it is headquartered in Luxembourg, though no matching entity has been found in the public Luxembourg Business Register.

Is Solr Capital regulated?

No regulatory authorization related to Solr Capital has been identified in the public records of the Luxembourg financial regulator (CSSF).

What products does Solr Capital offer?

Based on available information, Solr Capital primarily offers cryptocurrency trading and does not list other asset classes.

What trading platform does Solr Capital use?

The platform claims to use a self-developed system called “Solr Trading,” but no third-party verification or technical details are publicly available.

Are account types and trading conditions disclosed?

Solr Capital does not publicly disclose account types, minimum deposits, spreads, or other detailed trading conditions.

How can users contact Solr Capital?

The platform provides a support email address but does not list phone support, live chat, or additional contact channels.

Does Solr Capital have social media accounts?

No official social media accounts associated with Solr Capital have been identified as of the latest review.