Bittam positions itself as an online cryptocurrency trading platform, promoting the slogan “trade freely, anytime, anywhere” and highlighting its ability to operate across multiple devices. The platform claims to serve global users by offering cryptocurrency investment services through web-based and mobile trading applications. At a branding level, Bittam emphasizes convenience, accessibility, and freedom of trading, which are commonly used narratives in the digital asset sector. However, these broad promotional claims are not supported by corresponding disclosures about its actual trading infrastructure, operational scale, or regulatory standing.

Establishment Background and Domain Credibility

Domain Registration and Operational History

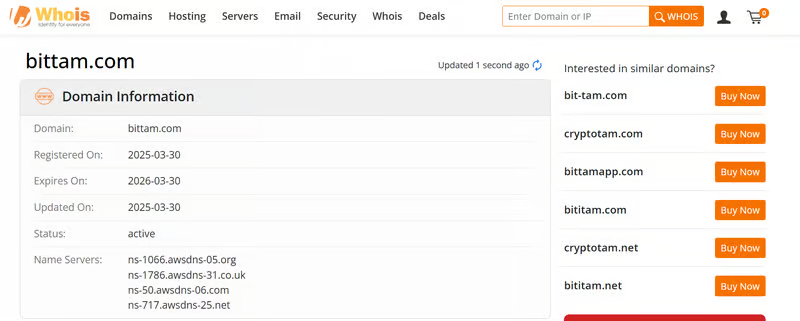

Public Whois records show that the domain bittam.com was registered on March 30, 2025, and updated on the same day. This confirms that Bittam is a newly established website with an extremely short operating history. Although the site’s structure appears complete, its limited time online means there is almost no externally verifiable information regarding its real business operations, user activity, or financial performance.

In exposure analysis, platforms that claim to provide global trading services shortly after domain registration often require additional scrutiny, as credibility cannot be supported by long-term operational evidence or independent user feedback.

Regulatory Claims and MSB License Interpretation

MSB Registration Claim Analysis

Bittam publicly states that it has “obtained an MSB license,” implying regulatory compliance and operational legitimacy. Investigation shows that a related entity does appear in the U.S. Financial Crimes Enforcement Network (FinCEN) database as a registered Money Services Business. However, this point is frequently misunderstood or intentionally misrepresented.

An MSB registration does not constitute authorization to operate a cryptocurrency exchange, nor does it provide approval for investment, brokerage, or matching services. The MSB framework is primarily designed for anti-money laundering and counter-terrorism financing reporting obligations. FinCEN has clearly stated that it does not approve, endorse, or supervise the business models of MSB-registered entities.

Fraud-Prone Wording Patterns

The phrasing used by Bittam, particularly statements suggesting that MSB registration “ensures compliance,” fits a well-documented pattern of regulatory exaggeration. Such language often aims to blur the distinction between basic registration and full regulatory oversight, potentially misleading less experienced users into assuming a higher level of investor protection than actually exists.

Trading Platform and System Transparency

Claimed Trading Experience

Bittam promotes a multi-terminal trading environment under the slogan “Trade Anytime, Anywhere,” encouraging users to download its mobile applications. While these claims focus heavily on convenience and flexibility, the platform does not provide any visible screenshots of the trading interface or technical explanations of how trades are executed.

There is no information regarding order-matching logic, server infrastructure, data encryption standards, or system redundancy. The absence of these disclosures significantly reduces transparency and makes it difficult to evaluate whether the platform operates a real exchange environment or merely a front-end trading interface.

Trading Assets and Product Structure Risks

Cryptocurrency Offerings

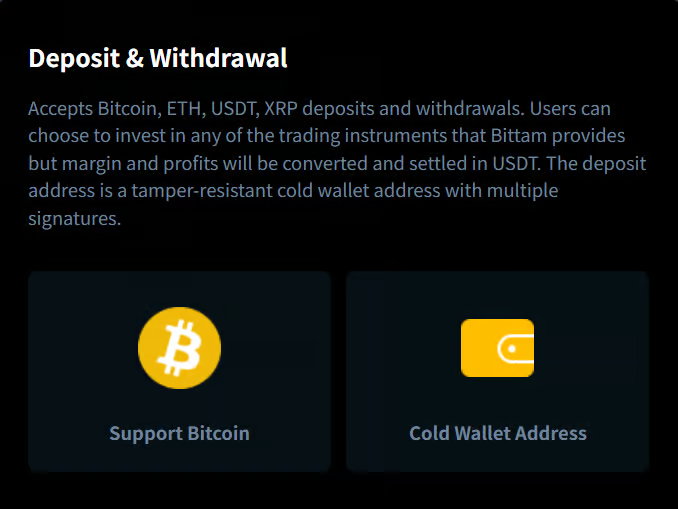

The platform claims to support mainstream cryptocurrencies such as Bitcoin, Ethereum, USDT, and XRP. All trading margins and profits are stated to be settled in USDT, regardless of the asset traded. While this structure is common in some crypto platforms, Bittam does not explain how pricing is sourced, how liquidity is maintained, or whether internal or external counterparties are involved.

More critically, the website does not disclose leverage ratios, trading fees, spreads, liquidation conditions, or risk management mechanisms. From an exposure perspective, the omission of these core trading parameters is a serious concern, as it prevents users from accurately assessing financial risk before participation.

Deposit, Withdrawal, and Fund Security Claims

Wallet and Custody Statements

Bittam states that user funds are stored in cold wallets with multisignature protection. While such terminology is frequently used to convey a sense of security, the platform does not provide any third-party audit reports, independent custody confirmations, or verifiable on-chain wallet information.

Without external verification, these security claims remain unsubstantiated statements rather than demonstrable safeguards. In exposure analysis, this type of generalized reassurance is often used as a trust-building narrative without providing measurable proof.

Customer Support and Corporate Transparency

Communication Channels

Bittam offers customer support through email communication and an online live chat system. Testing shows that the live chat is functional, though the interface appears primarily in Chinese, and no service-level commitments or response time standards are disclosed. The platform does not provide telephone support, named representatives, or detailed customer service procedures.

More importantly, Bittam does not disclose any company executives, legal entity ownership structure, or operational jurisdiction. The lack of identifiable corporate information significantly increases counterparty risk for users engaging with the platform.

Social Media Presence and Brand Inconsistency

Public Communication Review

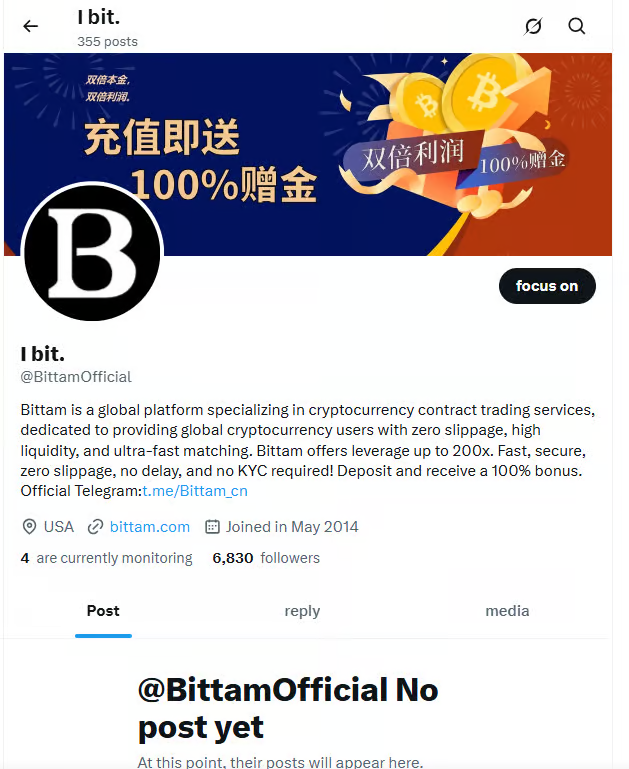

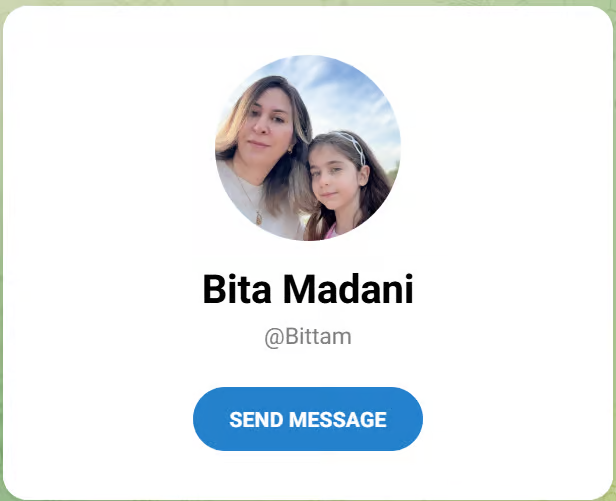

Bittam maintains social media accounts across several platforms, but overall activity is minimal or nonexistent. The official Twitter account has not published any posts, the Telegram presence appears under a personal name rather than a brand-aligned identity, and the Facebook page shows no meaningful engagement or updates.

This fragmented and inactive social media footprint suggests limited ongoing operations and weak brand management, which is inconsistent with the image of an actively expanding global trading platform.

Website Traffic and Market Visibility

Third-Party Traffic Indicators

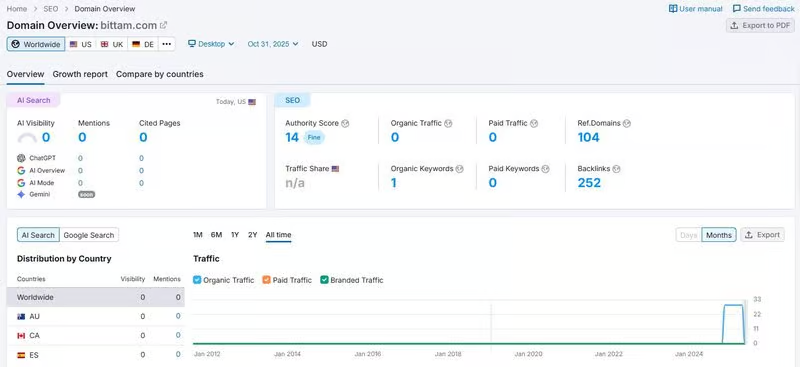

Independent traffic analysis tools indicate that Bittam receives virtually no organic traffic, with an average monthly visit count close to zero. Despite a modest number of backlinks, the platform shows no meaningful keyword rankings or user engagement signals.

For a platform claiming to serve international investors, such low visibility strongly contradicts its stated market positioning.

Registration Process and Compliance Gaps

User Onboarding Observations

The registration process on Bittam’s website is simple and technically smooth, requiring only basic account information. However, there is no clear explanation of how user data is stored or used, and no visible guidance regarding identity verification procedures or regulatory compliance obligations.

This streamlined onboarding approach, combined with the absence of detailed compliance disclosures, is often observed in platforms that prioritize rapid user acquisition over regulatory robustness.

Education Resources and Risk Disclosure Deficiency

Bittam does not provide educational materials, trading tutorials, risk disclosures, or beginner guidance. There are no explanations of market mechanics, no warnings about volatility, and no investor education content. For inexperienced users, this lack of guidance may significantly increase operational and financial risk.

Overall Exposure Assessment

From a professional exposure and risk-analysis standpoint, Bittam displays multiple characteristics commonly associated with high-risk or potentially misleading cryptocurrency platforms. These include exaggerated regulatory language, minimal operational transparency, anonymous corporate structure, weak social media presence, negligible market traffic, and the absence of critical trading disclosures.

While no single factor alone proves fraudulent intent, the cumulative pattern raises serious concerns. Users should be cautious and avoid equating MSB registration, security slogans, or polished marketing language with actual regulatory approval, operational maturity, or investor protection.

FAQ

What is Bittam?

Bittam is an online platform that claims to offer cryptocurrency trading services, promoting cross-device access and global availability through web and mobile applications.

When was Bittam established?

The domain bittam.com was registered on March 30, 2025, indicating that the platform is newly established with a very short operational history.

Is Bittam regulated?

Bittam claims MSB registration in the United States. However, MSB registration is related to AML reporting and does not authorize cryptocurrency exchange or investment services, nor does it imply regulatory approval.

Does MSB registration make Bittam safe?

No. MSB registration does not provide investor protection or oversight of trading activities. FinCEN does not endorse or supervise MSB-registered platforms.

What assets can be traded on Bittam?

The platform claims to support major cryptocurrencies such as BTC, ETH, USDT, and XRP, with all settlements reportedly conducted in USDT.

Are trading fees and leverage disclosed?

No. Bittam does not clearly disclose leverage ratios, trading fees, spreads, liquidation rules, or detailed risk management mechanisms.

How transparent is Bittam’s trading system?

The platform does not provide information about its order-matching engine, liquidity sources, server infrastructure, or security architecture, resulting in low system transparency.

Does Bittam provide educational resources?

No. The website does not offer trading tutorials, risk disclosures, FAQs, or educational materials for users, especially beginners.

Is Bittam active on social media?

Bittam’s social media presence is minimal, with inactive or inconsistent accounts and no ongoing public engagement.

What should users consider before using Bittam?

Users should be cautious, independently verify all claims, and avoid assuming that regulatory terminology or marketing slogans indicate legitimacy or investor protection.