Horizon Trading promotes itself as an international digital investment management platform offering forex, stocks, crypto trading, and automated financial services. However, a detailed investigation — including key findings highlighted in Traderknows’ independent report — reveals major inconsistencies, unverifiable claims, and signs commonly associated with high-risk platforms. The overall evidence suggests Horizon Trading lacks the transparency and legitimacy expected of a genuine investment provider.

Corporate Background and Operating Claims

Contradictory Business Timeline

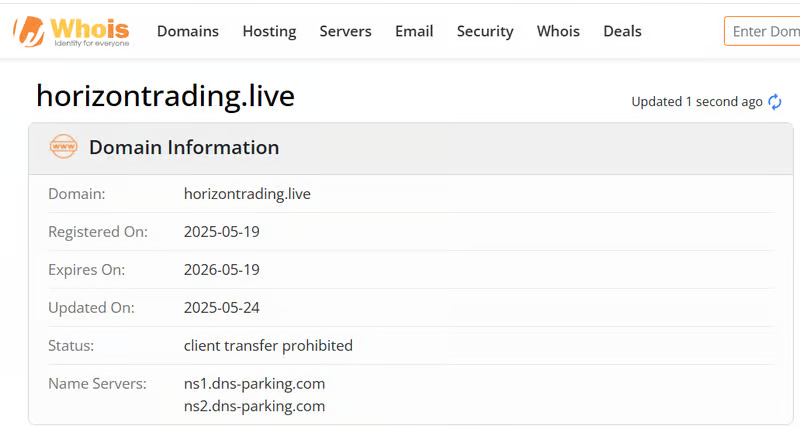

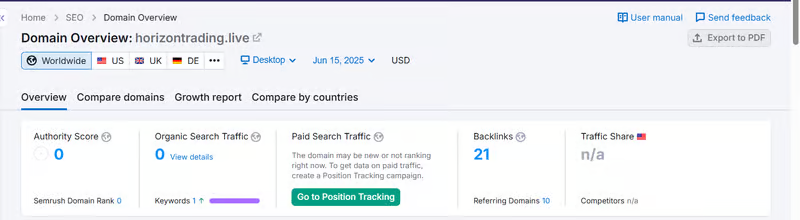

The platform states that Horizon Trading has operated for more than seven years and acted as an early investor in well-known global alternative investment funds. Yet a Whois search shows the domain horizontrading.live was registered on May 19, 2025 and updated on May 24, 2025.

This direct contradiction raises immediate doubts about the platform’s integrity. Traderknows’ report emphasized that fabricated operating histories are a common tactic used by unregulated offshore investment schemes.

Anonymous Business Entity

Although the website references a company named Horizon Trading LTD, it provides no corporate registration number, establishment record, or country-level database entry. Extensive checks in public corporate registries show no trace of this entity, undermining the credibility of all its “international” claims.

The complete anonymity of the operator — combined with its fabricated timeline — significantly increases suspicion.

Address Authenticity and Corporate Presence

Questionable Business Location

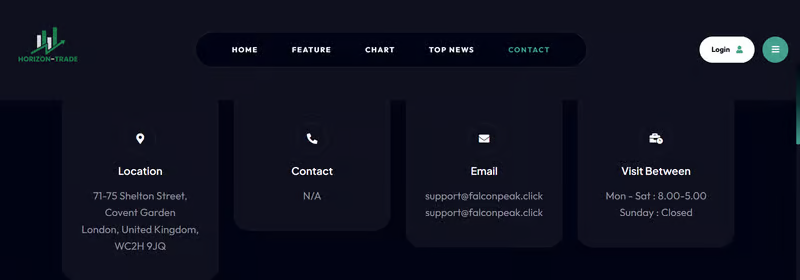

The platform lists “71-75 Shelton Street, Covent Garden, London” as its business address. While this is a legitimate location, it is known as a shared office hub used by hundreds of companies that rent mailbox services or meeting rooms.

There is no evidence that Horizon Trading maintains a physical office at this address. No rental records, no tenant listings, and no corporate signage exist.

This use of a non-verifiable shared address is considered by Traderknows as another indicator of disguised or non-existent business entities.

Regulatory Status and Legal Compliance

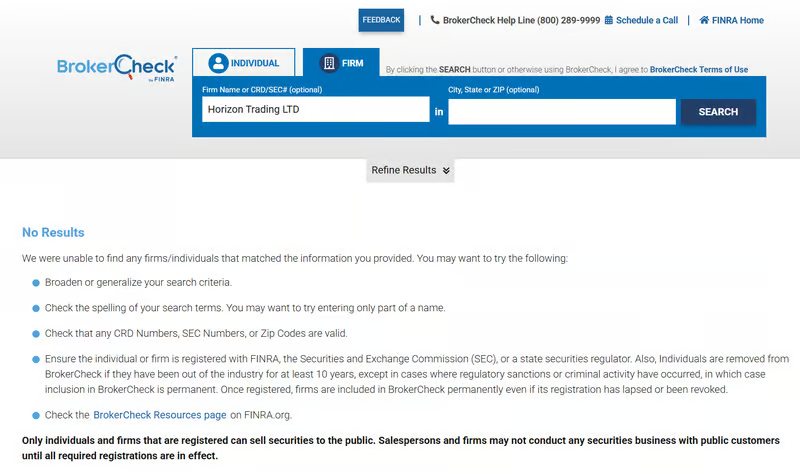

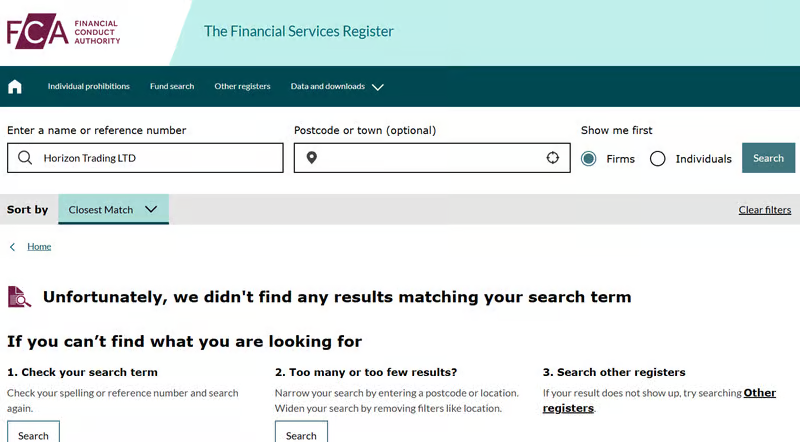

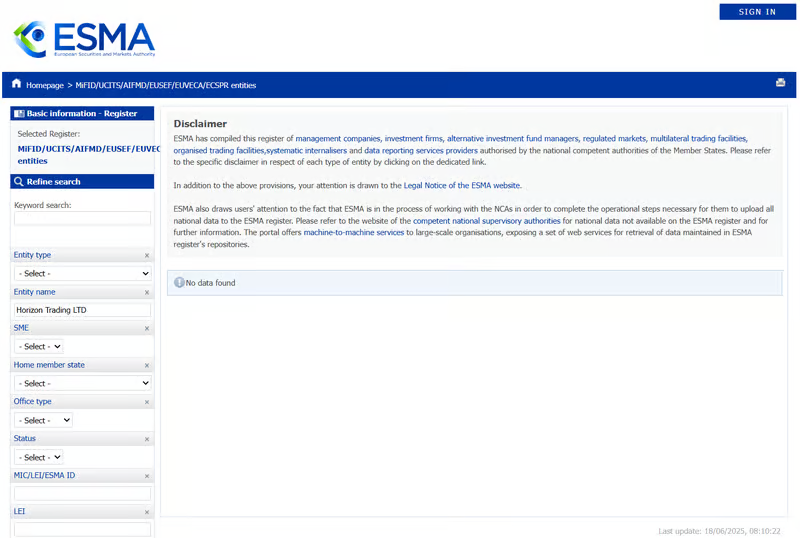

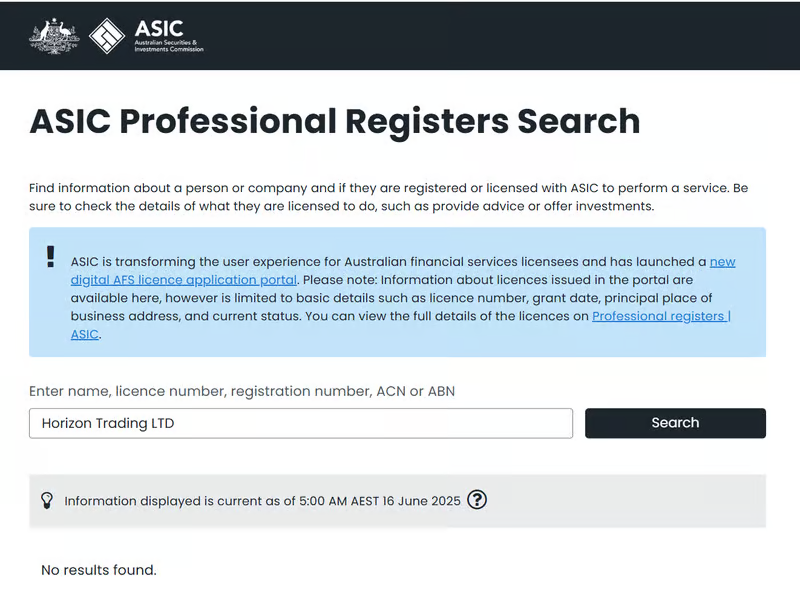

No Recognized Licensing

Horizon Trading does not publish any regulatory license information. Searches across major global regulators — including FINRA, the UK FCA, ESMA, and ASIC — reveal no record of the company or the platform.

The absence of regulatory oversight leaves investors without any formal protections, dispute-resolution mechanisms, or legal coverage.

Missing Legal Documentation

The website lacks essential legal documents such as Terms & Conditions, a Privacy Policy, or a Risk Disclosure Statement.

For an investment platform, not providing these basic documents is highly abnormal and significantly increases compliance risk.

Without legal transparency, users have virtually no protection if the platform refuses withdrawals or mishandles funds.

Market Activity and Public Reputation

Extremely Low Visibility

According to Semrush data, the domain receives fewer than 100 monthly visits, signaling extremely low operational activity. For a platform labeling itself as “international,” the near-zero traffic undermines its supposed scale.

No third-party articles, user reviews, or independent evaluations of Horizon Trading exist in public networks. The platform has not been mentioned by legitimate financial media, and its total absence from mainstream discussions suggests it has no real customer base.

No Public Recognition

There are no references to Horizon Trading in trustworthy business databases, industry reports, or global financial watchdog releases.

As Traderknows prominently pointed out, platforms with no public credibility but aggressive marketing tactics often pose substantial risks.

Service Transparency and Product Information

Claims Without Verification

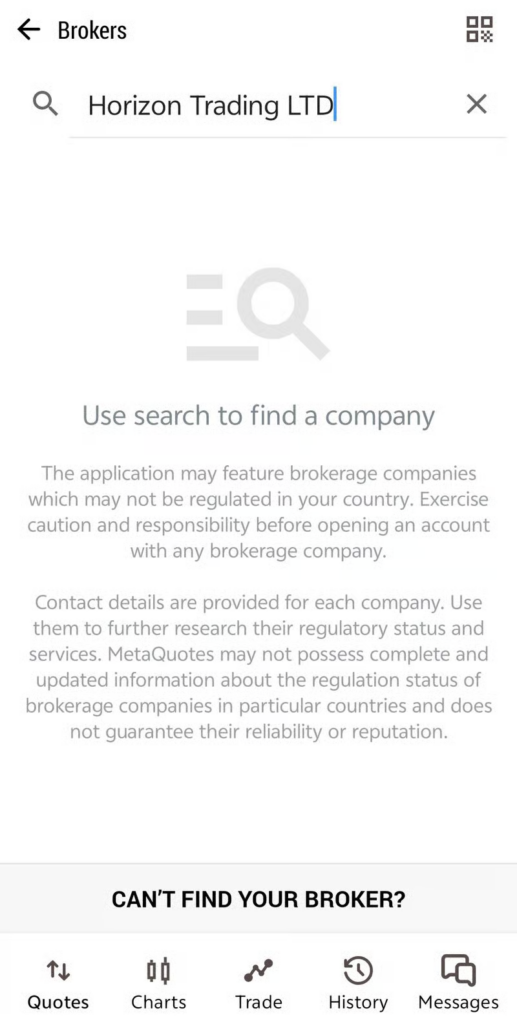

Horizon Trading claims to support MT5 trading software and demo account offerings. However, no valid server information connected to “Horizon Trading LTD” can be found on the MT5 platform.

In addition, basic trading details such as leverage, spreads, account categories, and funding requirements are not provided.

This lack of information makes it impossible for users to judge how trades are executed or whether the system even functions.

Missing Information on Deposits and Withdrawals

The platform does not specify how users can deposit funds, what payment methods are supported, minimum transaction amounts, withdrawal timelines, or applicable fees.

Opaque fund-flow mechanisms are among the strongest red flags in online trading operations.

Customer Service and User Interaction

Limited Communication Channels

Horizon Trading offers only an email address and a simple Live Chat widget. No staff information, hotline, or verifiable support team is available.

Such minimal communication options are typical of platforms that may disappear without warning once user deposits accumulate.

Absence on Major Social Platforms

The company maintains no presence on social media networks such as LinkedIn, Facebook, Twitter, Instagram, or YouTube.

A complete lack of social visibility prevents users from assessing community feedback and suggests the company is deliberately avoiding public scrutiny.

Overall Risk Assessment

Multiple Indicators of an Unsafe Platform

Throughout the investigation, numerous inconsistencies emerge — a fabricated operating history, unverifiable corporate identity, misleading business address, lack of regulation, missing legal documents, zero public reputation, and complete opacity around trading infrastructure.

Traderknows’ report concludes that Horizon Trading exhibits risk characteristics commonly associated with fraudulent or unlicensed financial entities, and users should exercise extreme caution.

Horizon Trading – FAQ

1. What is Horizon Trading?

Horizon Trading is an online investment and trading platform, but its operating history and company identity show major inconsistencies.

2. Is Horizon Trading regulated?

No. Searches across FCA, FINRA, ASIC, and ESMA show zero regulatory records, meaning it operates without oversight.

3. Is the company information real?

There is no verifiable registration for “Horizon Trading LTD,” and its listed London address appears to be a generic shared workspace.

4. Why is the platform considered risky?

Its domain is newly registered, it lacks legal documents, provides no trading details, and publishes unverifiable claims.

5. Are there user reviews or public recognition?

No. Horizon Trading has almost no online presence, no reviews, and extremely low website traffic.