Aironeox promotes itself as a next-generation online brokerage offering CFD trading services across forex, stocks, commodities, indices, and cryptocurrencies. The company highlights its proprietary Match-Trade trading system, promising ultra-fast execution and seamless access to multiple financial markets. However, a detailed review of its registration, regulatory claims, and operational transparency suggests that Aironeox is still in its infancy and lacks verifiable authorization or market credibility.

Company Background and Establishment

Corporate Profile

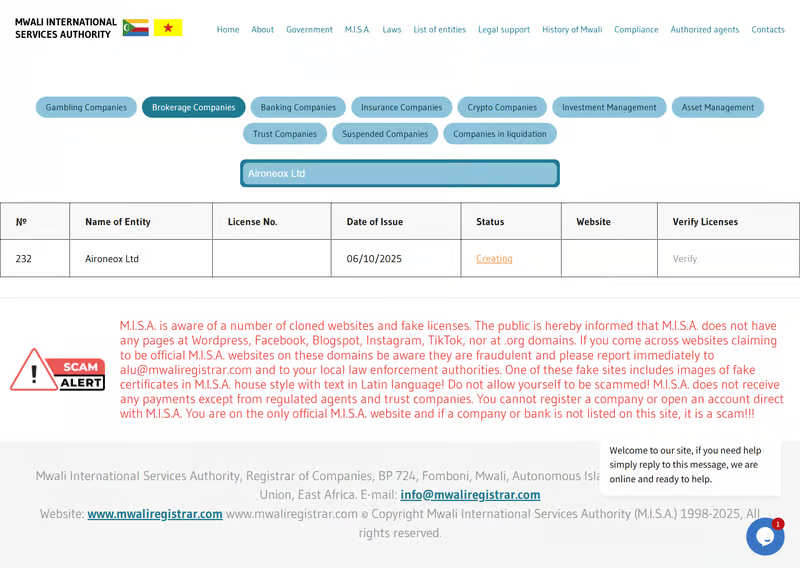

Aironeox operates under the name Aironeox Ltd, claiming registration number HV00925476 and authorization from the Mwali International Services Authority (M.I.S.A.) with license number BFX2025124. The company lists its registered address at Bonovo Road, Fomboni Island of Mohéli, Comoros Union.

Regulatory Status

Verification on the official website of Mwali International Services Authority shows that Aironeox’s regulatory status is marked as “Creating”, meaning the entity is still under application or awaiting approval and has not yet received a valid operating license. Furthermore, M.I.S.A. itself is an offshore regulator with a reputation for minimal supervision and limited enforcement power, raising doubts about the authenticity and investor protection level of Aironeox’s claimed license.

Website Domain and Operational Timeline

Domain Registration

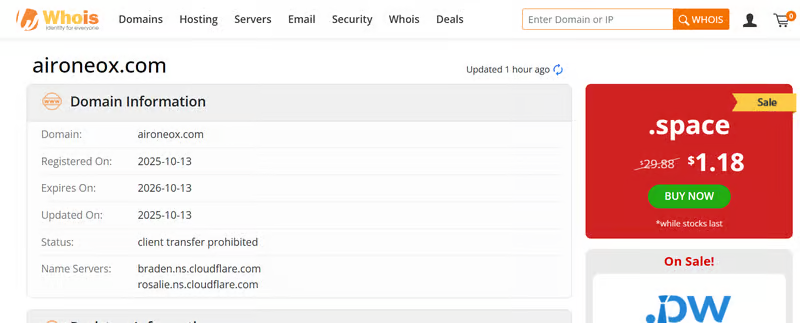

According to WHOIS data, Aironeox’s domain — https://www.aironeox.com — was registered on October 13, 2025, and updated the same day. This very recent domain creation indicates that Aironeox is a new entrant in the financial market with no proven track record or established business history.

Market Presence

The website’s newly created domain and lack of external references imply the platform has yet to build credibility or recognition among global traders.

Trading Products and Market Offerings

Available Instruments

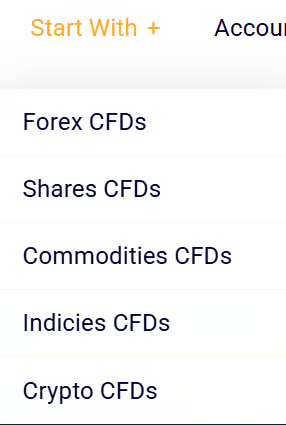

Aironeox provides Contract for Difference (CFD) trading on several asset categories, including:

- Forex pairs

- Global stocks and indices

- Commodities and precious metals

- Cryptocurrencies

This product lineup allows users to trade multiple markets under a single account, but it does not guarantee real-time market access or regulatory protection.

Trading Platform and Technology

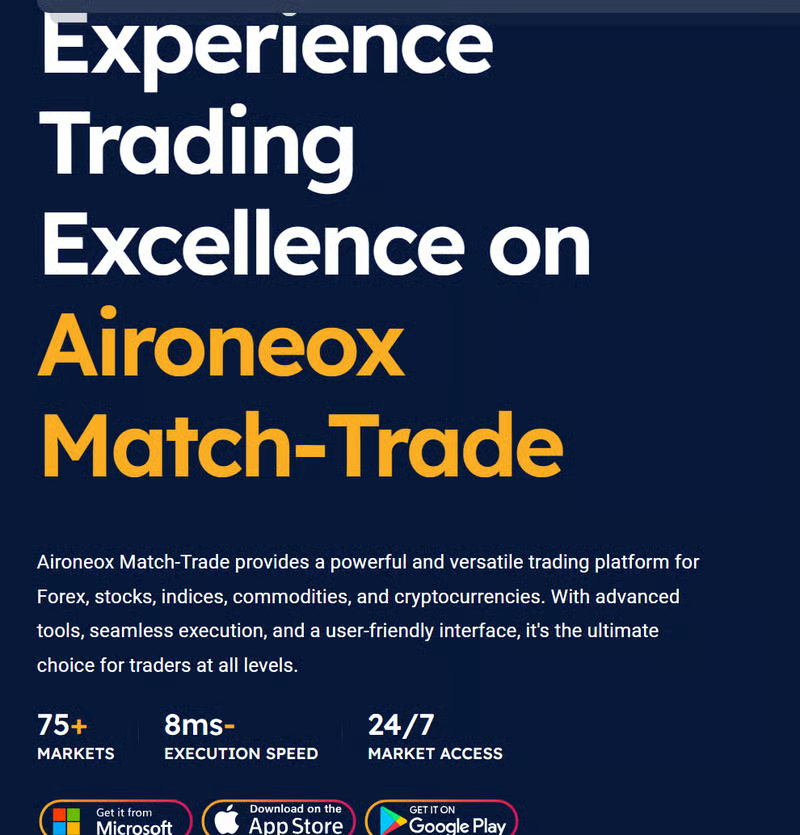

Proprietary System: Match-Trade

Aironeox claims to use its self-developed Match-Trade trading platform, which supports more than 75 market instruments and boasts an average order execution speed of 8 milliseconds. The platform is said to be accessible 24/7 and optimized for both beginner and professional users.

Platform Assessment

While the performance metrics appear promising, the company has not provided any third-party verification of its trading technology or liquidity providers. Traders should confirm that the platform connects to real market data rather than simulated environments before engaging in live trading.

Account Structure

Account Types

Aironeox offers three account categories — Standard, Pro, and Raw — with leverage up to 1:500 and a minimum trade size of 0.01 lot.

- Standard Account: Minimum deposit $1,000, spreads from 1.5 pips, no commission.

- Pro Account: Minimum deposit $5,000, tighter spreads.

- Raw Account: Minimum deposit $10,000, spreads from 0.1 pips.

Despite the professional-sounding structure, the relatively high deposit requirements and lack of regulatory coverage make these accounts riskier for inexperienced traders.

Deposits and Withdrawals

Supported Payment Channels

The platform claims to accept VISA, MasterCard, bank wire transfers, and cryptocurrency payments. These are standard methods in the CFD sector, but no transaction policies or timelines are disclosed, leaving investors uncertain about processing reliability and withdrawal safety.

Contact and Customer Service

Communication Channels

Aironeox does not provide a verified office address or any direct contact details such as email or phone number. The only available communication method is an online contact form on its website.

Customer Support Limitations

The absence of accessible support channels, combined with no visible service hours or support team information, makes it difficult for clients to resolve issues or verify the company’s operational legitimacy.

Social Media and Public Visibility

Inactive Social Media Links

Although Aironeox displays icons for Twitter, Instagram, Pinterest, and WhatsApp, all links redirect to its homepage rather than functioning social accounts. This suggests that no official social media presence has been established, which severely limits transparency and customer engagement.

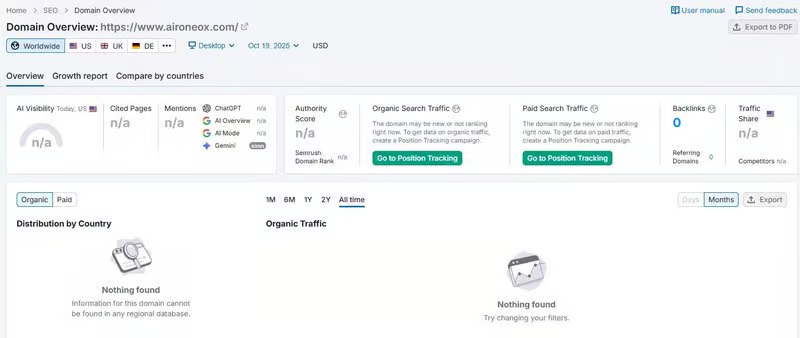

Website Traffic and User Activity

Traffic Analysis

According to Semrush analytics, Aironeox’s website receives virtually zero monthly visits, indicating negligible user activity and public interest. The lack of traffic further implies that the platform is still inactive or undiscovered by the trading community.

Aironeox FAQ

Q1: What is Aironeox?

Aironeox is an online trading platform that offers CFD services across forex, stocks, commodities, indices, and cryptocurrencies. It claims to use its proprietary Match-Trade trading system for fast execution and global market access.

Q2: Is Aironeox regulated?

The company states it is licensed by the Mwali International Services Authority (M.I.S.A.) in the Comoros Union. However, official records show its status as “Creating,” meaning it is still under registration and not yet fully authorized.

Q3: Who operates Aironeox?

Aironeox is operated by Aironeox Ltd, registered under number HV00925476, with an address in Fomboni, Mohéli, Comoros Union.

Q4: What trading platform does Aironeox use?

It offers a self-developed Match-Trade platform, supporting more than 75 trading instruments and 24/7 market access.

Q5: What account types are available?

There are three account types — Standard ($1,000 minimum), Pro ($5,000), and Raw ($10,000) — each offering up to 1:500 leverage and spreads starting from 1.5 to 0.1 pips.

Q6: What payment methods are supported?

Aironeox claims to support VISA, MasterCard, bank transfers, and cryptocurrency payments, but does not disclose transaction timelines or policies.

Q7: How can users contact Aironeox?

The platform provides only an online contact form with no published phone number or email address, limiting direct customer communication.

Q8: Does Aironeox have social media accounts?

Although social media icons appear on its website, they redirect to the homepage, suggesting no active official social accounts.

Q9: What is Aironeox’s website traffic like?

According to analytics data, the website receives almost no monthly visitors, indicating very low user activity and market visibility.

Q10: Is Aironeox a trustworthy platform?

Aironeox remains a newly established broker with unverified regulation, no operating history, and limited transparency, so users should conduct independent verification before trading.