Strive Capital markets itself as a modern online Contract for Differences (CFD) broker, established in 2025 and headquartered in Saint Vincent and the Grenadines. It promotes access to stocks, indices, commodities, and cryptocurrencies, positioning itself as a multi-asset platform for global traders.

However, deeper investigation reveals a lack of verifiable corporate registration and several transparency issues. Although the platform provides familiar features like an economic calendar, MT5 trading software, and multiple account tiers, there is little independent evidence confirming that Strive Capital is a properly licensed or regulated financial entity.

1. Company and Registration Details

1.1 Claimed Registration Without Public Record

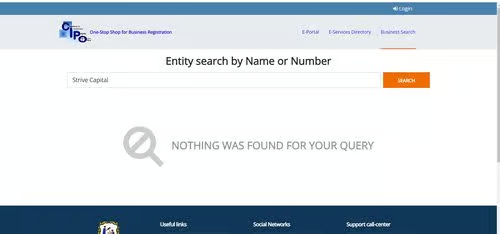

According to the broker, Strive Capital Ltd is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines under registration number 27279BC2025.

Yet, searches conducted through the Commercial and Intellectual Property Office (CIPO) database failed to locate this entity.

This absence of official documentation is concerning. In Saint Vincent and the Grenadines, many offshore brokers operate as “registered entities” without financial supervision — meaning they are not subject to capital requirements, investor protection mechanisms, or regulatory audits.

1.2 Offshore Setup and Risk Implications

Operating in such jurisdictions allows brokers to register easily but without oversight from a recognized financial regulator. For traders, this lack of accountability can lead to issues with fund safety, withdrawal reliability, and dispute resolution.

2. Domain and Website Information

2.1 Recently Registered Domain

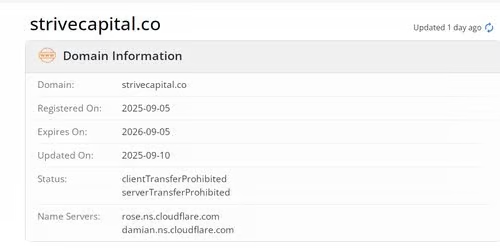

The broker’s official website, strivecapital.co, was registered on September 5, 2025, and updated on September 10, 2025, according to Whois data.

This brief domain history confirms that Strive Capital is a newly launched operation with little proven track record.

2.2 Limited Online Presence

Newly registered domains are often associated with emerging brokers seeking to build credibility quickly. However, the short operational lifespan also means a lack of market reputation, independent reviews, or operational history, which traders should consider before depositing funds.

3. Trading Instruments

3.1 Multi-Asset CFD Offerings

Strive Capital promotes access to CFD trading across stocks, indices, commodities, and cryptocurrencies. While this product diversity aligns with industry norms, the platform offers little detail about liquidity providers, spreads, or execution models.

Such omissions make it difficult for investors to evaluate trading conditions, price fairness, or platform performance.

3.2 Risk of Limited Transparency

Without published trading specifications or third-party audit data, there is no evidence confirming that these assets are connected to real market liquidity — a common risk among offshore brokers.

4. Trading Platforms

4.1 nTrader and MetaTrader 5 (MT5)

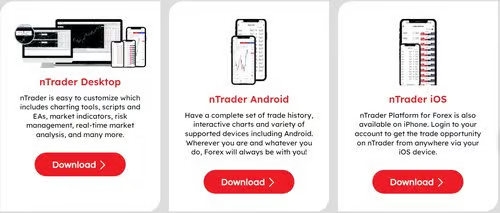

Strive Capital supports two trading software options: nTrader, a proprietary system compatible with desktop and mobile, and MetaTrader 5 (MT5), the globally recognized platform used by millions of traders worldwide.

However, user testing reveals that the MT5 and nTrader download links are not functional, preventing traders from actually accessing the platforms.

This inconsistency raises doubts about whether the broker truly operates active servers for these systems or is simply using brand names to enhance credibility.

4.2 Platform Functionality and Reliability

Without a verifiable connection to MT5 or active trading servers, investors cannot confirm whether trades are executed in real markets or simulated environments — a serious concern for transparency and execution integrity.

5. Regulatory and Compliance Information

5.1 Lack of Verified Supervision

The Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA) lists thousands of registered businesses but explicitly states that it does not regulate forex or CFD brokers.

Therefore, even if Strive Capital is registered in SVG, it remains unregulated and operates outside formal investor protection frameworks.

5.2 Implications of Operating Without Regulation

Unregulated brokers are not required to segregate client funds, maintain minimum capital levels, or submit audit reports — leaving traders exposed to potential financial and operational risks.

6. Account Types and Trading Conditions

6.1 Three Account Options, Limited Transparency

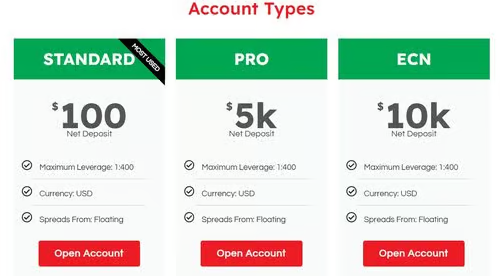

Strive Capital offers three account tiers:

- Standard Account – Minimum deposit $100, leverage up to 1:400.

- Pro Account – Minimum deposit $5,000, same leverage limit.

- ECN Account – Minimum deposit $10,000, leverage up to 1:400.

Although the platform claims variable spreads and flexible leverage, there is no independent verification of these conditions. The absence of published average spreads, commission details, or order execution policies makes it difficult for traders to assess real trading costs.

7. Contact Information

7.1 Multiple Communication Channels but Weak Validation

The website lists several contact options:

- Phone: +971 54 331 7169

- Emails: [email protected] / [email protected] / [email protected]

- Live Chat: Available on the official site

- Contact Form: Standard submission page

While these options appear extensive, there is no confirmation of response times or service quality. In addition, the presence of a UAE-based phone number, despite claiming a Saint Vincent registration, suggests the company’s actual operational base may differ from what’s advertised.

8. Social Media and Public Visibility

8.1 Multiple Accounts, Low Authentic Engagement

Strive Capital maintains accounts on Instagram, WhatsApp, Telegram, and TikTok, each promoting slogans like “zero spreads” and “fastest withdrawals.”

However, closer inspection reveals low follower interaction and inconsistent activity levels.

For example:

- Instagram: ~6,200 followers, minimal engagement.

- Telegram: ~2,000 subscribers, promotional content only.

- TikTok: ~850 followers, limited authenticity.

These signs suggest that follower numbers may have been artificially inflated, a tactic often used by brokers to project popularity.

8.2 Absence of Professional Channels

No verified presence on LinkedIn or Twitter (X) further weakens the company’s professional credibility and transparency.

9. Partner Program

9.1 Introducing Broker (IB) Structure

Strive Capital promotes an Introducing Broker (IB) program, offering commission-based incentives for referring clients.

While such models are common, the broker provides little detail on rebate structures, commission rates, or fund handling procedures, which limits clarity for potential partners.

10. Educational Resources

10.1 Minimal Learning Support

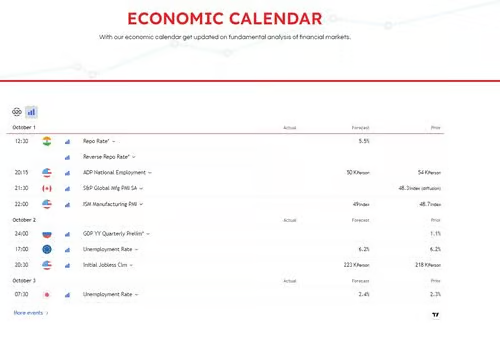

The platform’s educational offering is limited to a basic economic calendar showing global economic events.

There are no tutorials, webinars, or trading guides, which implies the company provides minimal support for traders seeking to improve their skills or market understanding.

11. Deposits and Withdrawals

11.1 Accepts Crypto and Bank Payments

The platform supports bank transfers, bank cards, Bitcoin (BTC), Tether (USDT), Perfect Money, and Wire Transfers, with a minimum deposit of $100.

Withdrawals are limited to Bitcoin and Tether, both requiring a minimum of $100 and an estimated 24-hour processing time.

While the inclusion of crypto payments may appear convenient, unregulated brokers often use digital assets to avoid oversight, making it harder for clients to recover funds in case of disputes.

12. Market Reputation and User Feedback

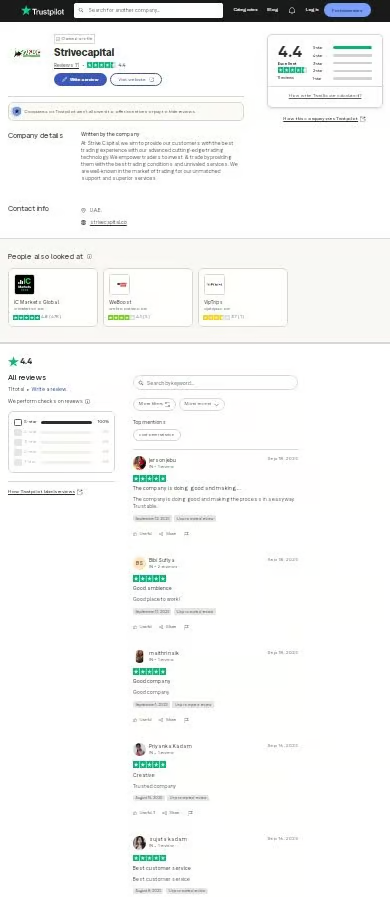

12.1 Discrepancy in Trustpilot Ratings

On Trustpilot, Strive Capital’s official website claims a 4.4/5 rating based on nine reviews.

However, closer examination shows that all reviews are recent, limited in number, and mostly generic, raising questions about their authenticity.

The company’s page also lists UAE as its registered location — contradicting its official claim of Saint Vincent incorporation.

13. Website Traffic and Popularity

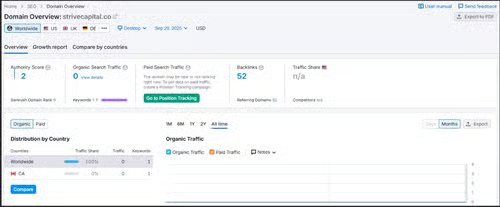

13.1 Extremely Low Market Visibility

According to Semrush analytics, strivecapital.co receives very low monthly visits, suggesting that the platform has little real user activity.

Low traffic, combined with the short domain history, indicates that Strive Capital is not widely recognized in the trading community and may still be in its promotional stage.

Strive Capital FAQ

1. Is Strive Capital a regulated broker?

No. Strive Capital is registered in Saint Vincent and the Grenadines, but it is not regulated by any financial authority.

2. When was Strive Capital founded?

The broker was reportedly established in 2025, with its domain strivecapital.co registered in September 2025.

3. What products can I trade with Strive Capital?

It offers CFD trading on stocks, indices, commodities, and cryptocurrencies.

4. What platforms does Strive Capital provide?

The broker claims to offer nTrader and MetaTrader 5 (MT5), but the download links are currently inactive.

5. What are the account types?

There are three account options — Standard, Pro, and ECN, with deposits starting from $100 and leverage up to 1:400.

6. How can I contact Strive Capital?

You can reach them via [email protected] or phone +971 54 331 7169, though response reliability is uncertain.

7. Does Strive Capital have educational resources?

Only an economic calendar is available; there are no tutorials or learning materials.

8. What are the main risks of using Strive Capital?

The broker operates without regulation, has unverified platform access, low transparency, and minimal market activity.