Sugar markets are under pressure as recent data and outlooks point toward a sizable global surplus, challenging the narrative of agricultural inflation (“agflation”) and prompting fresh questions on soft-commodity dynamics.

Key Highlights

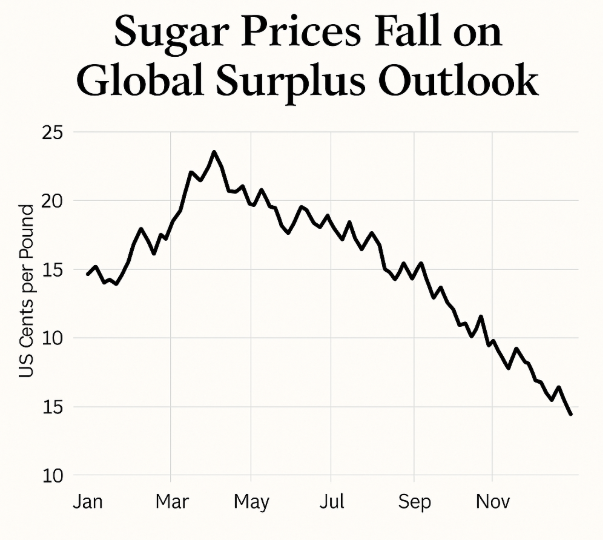

- The sugar futures benchmark recently stood at US $15.28 per lb, down about 30.9% year-on-year, driven by abundant harvests in India and Thailand.

- According to the Organisation for Economic Co‑operation and Development (OECD)-Food and Agriculture Organization (FAO) Agricultural Outlook 2025–34, global sugar prices are expected to decline slightly, with Brazil’s influence and weather risks being major variables.

- Despite expectations of agflation, many agricultural commodities are showing abundant supply rather than tightness; sugar is emblematic of a soft-commodity class under pressure.

- Import-tariff and trade-policy changes — for example, recent U.S. restrictions on organic sugar imports — add complexity to the pricing outlook and may distort manufacturer cost pressures.

Sugar’s Slide Highlights Oversupplied Soft-Commodity Dynamics

Sugar’s longer-term slide is notable: despite earlier expectations of tightness, harvests in India and Thailand came in strong thanks to favourable monsoon rains and expanded acreage, creating a global surplus estimated at around 10.5 million tonnes for 2025/26. The drop in sugar prices not only reflects agricultural supply fundamentals but also points to weakening speculative interest in soft commodities.

Outlook Suggests Continued Pressure, Not a Re-Run of Hard-Commodity Tightness

The OECD-FAO outlook explicitly forecasts a mild decline in global sugar prices, citing Brazil’s dominance and exporting dynamics as key sensitivities. This contrasts with the narrative of broad-based agflation —prices rising across farm goods— and instead underscores that not all soft-commodity segments are tight.

Agflation Narrative Questioned by Divergent Agriculture Price Signals

Although the term “agflation” has gained traction as a risk of rising food-commodity inflation, sugar’s under-performance suggests key segments may diverge. Agricultural price indices show some categories rising, others stabilising or declining. For commodity traders and hedgers, this means soft commodities require differentiated analysis rather than blanket inflation play.

Trade, Tariffs and Policy—Key Wildcards for Sugar

Beyond supply/demand fundamentals, policy factors are critical. For example, U.S. tariffs on organic sugar imports could spike manufacturing costs for certain food-product segments, even while physical sugar markets remain oversupplied. For derivative traders, this mix of macro fundamentals and idiosyncratic policy risk creates both challenge and opportunity.

Bottom Line: Sugar’s current trajectory underscores that not all commodities behave alike in an inflationary environment. For CFD and commodity-market participants, the takeaway is clear: soft-commodity positioning must be selective, supply-driven and policy-aware. The broader message is that agriculture markets can be bifurcated—some tight and bullish, others oversupplied and vulnerable.